Ranking NBA teams by their all-time luxury tax payments

The NBA luxury tax system has been implemented for 20 seasons now. Every team with the exception of Charlotte Hornets and New Orleans Pelicans have been taxpayers for at least one season. In these two decades, teams have paid a combined $2.82 billion in penalties.

We’ve put together a ranking of all 28 taxpayers based on their expenditure, accompanied by data that sheds light on their spending efficiency. While several of these high-spending teams enjoyed successful seasons, others, despite hefty investments, saw underwhelming regular seasons and limited success in the playoffs.

Golden State Warriors

Total penalties: $501,550,833

Taxpaying seasons: 6

Average tax penalty: $83,591,806

Winning percentage in taxpaying seasons: 65.7 percent

Winning percentage in non-taxpaying seasons: 50.1 percent

The Golden State Warriors top this ranking with half a billion dollars spent on tax penalties. In just the last two years they spent $334 million due to the punitive repeater tax system. They are set to break their previous record for the highest single-season tax penalty this year with the first one projected to exceed $200 million.

Brooklyn Nets

Total penalties: $310,786,219

Taxpaying seasons: 8

Average tax penalty: $38,848,277

Winning percentage in taxpaying seasons: 56.4 percent

Winning percentage in non-taxpaying seasons: 39.3 percent

The Brooklyn Nets have spent the second most tax dollars thanks to three seasons deep in the tax. They spent a whopping $90.6 million in 2013-14, a figure that no other team reached again until 2021-22. They spent $172.2 million over the last three years but now will look to stay out of the tax until they construct a contender again.

Los Angeles Clippers

Total penalties: $258,201,679

Taxpaying seasons: 7

Average tax penalty: $36,885,954

Winning percentage in taxpaying seasons: 62.1 percent

Winning percentage in non-taxpaying seasons: 46.6 percent

The Los Angeles Clippers have been one of the highest taxpayers in recent seasons with little to no spending limit. They’ve spent $223 million in just the past two seasons and they continue to spend in pursuit of that elusive championship. They could wind up No. 1 in these rankings soon if they continue to spend deep into the repeater tax.

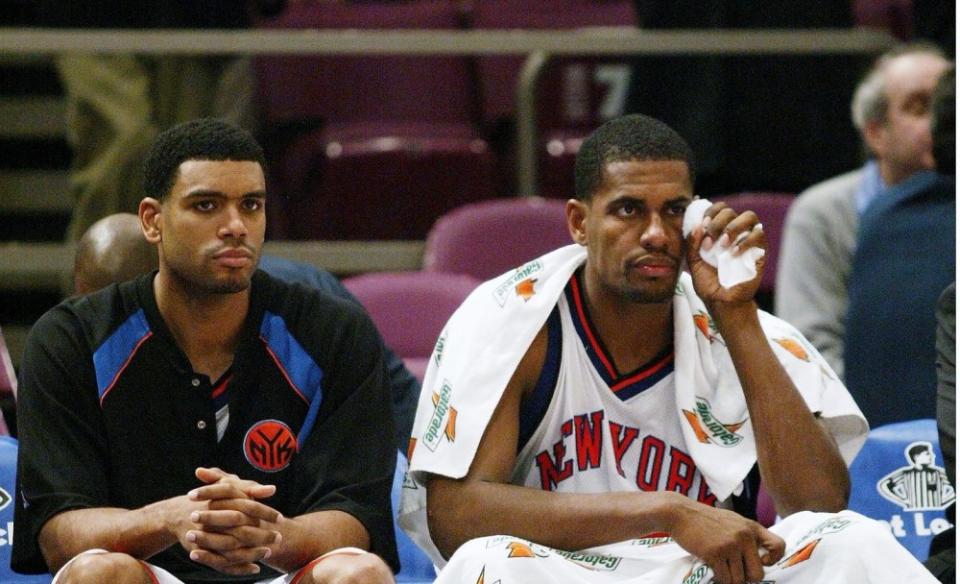

New York Knicks

Total penalties: $248,542,987

Taxpaying seasons: 10

Average tax penalty: $24,854,299

Winning percentage in taxpaying seasons: 39.5 percent

Winning percentage in non-taxpaying seasons: 43 percent

The New York Knicks are the most inefficient taxpayer in the history of the league. They are the only team with a lower winning percentage in taxpaying seasons than in non-taxpaying seasons among teams who paid the tax at least four times. In their 10 seasons in the tax, they only made the playoffs twice and won one playoff series.

Los Angeles Lakers

Total penalties: $207,731,219

Taxpaying seasons: 12

Average tax penalty: $17,310,935

Winning percentage in taxpaying seasons: 59.9 percent

Winning percentage in non-taxpaying seasons: 43.1 percent

The Los Angeles Lakers have been in the luxury tax for the most amount of seasons in league history. Despite their willingness to spend, they’ve only won two championships as taxpayers while they won the 2019-20 title below the tax. After three seasons in the tax, they’re cooling down spending to avoid the repeater tax.

Dallas Mavericks

Total penalties: $207,223,704

Taxpaying seasons: 10

Average tax penalty: $20,722,370

Winning percentage in taxpaying seasons: 65.2 percent

Winning percentage in non-taxpaying seasons: 51.1 percent

The Dallas Mavericks have been one of the most aggressive spenders with significant tax payments for nine straight seasons. They experienced a lot of success throughout that run in the 2000s, culminating in a championship in 2011. They paid a $56.7 million payment last season but are looking to avoid it this year after such a disappointing 2022-23 campaign.

Cleveland Cavaliers

Total penalties: $179,620,897

Taxpaying seasons: 7

Average tax penalty: $25,660,128

Winning percentage in taxpaying seasons: 66.7 percent

Winning percentage in non-taxpaying seasons: 39.1 percent

The Cleveland Cavaliers have shown a strong willingness to spend whenever they had a championship window around LeBron James. The $54 million penalty they paid in 2015-16 was the highest for a team that won the title until the Warriors topped it in 2021-22 with a $170.3 million payment. They could be deep into the tax in future seasons once they presumably extend Evan Mobley.

Milwaukee Bucks

Total penalties: $141,487,261

Taxpaying seasons: 4

Average tax penalty: $35,371,815

Winning percentage in taxpaying seasons: 62 percent

Winning percentage in non-taxpaying seasons: 47.6 percent

The Milwaukee Bucks have only been taxpayers for four seasons but already have the eighth most tax dollars spent. That’s because they spent $136 million in just the last two seasons alone. They should remain high in these rankings as long as they have Giannis Antetokounmpo, and they’re already projected to pay $50 million in penalties this year.

Boston Celtics

Total penalties: $120,610,902

Taxpaying seasons: 9

Average tax penalty: $13,401,211

Winning percentage in taxpaying seasons: 63.1 percent

Winning percentage in non-taxpaying seasons: 52 percent

The Boston Celtics were mostly taxpayers in the 2000s and have a championship in 2007-08 to justify their spending. They just spent $70 million on their team last season and those penalties could increase with Jaylen Brown‘s new extension set to start in 2024-25. They could have record-breaking payments starting in 2025-26 when they enter the repeater tax, the higher tax rates get implemented, and when Jayson Tatum‘s supermax would start.

Portland Trail Blazers

Oklahoma City Thunder

Total penalties: $106,443,551

Taxpaying seasons: 5

Average tax penalty: $21,288,710

Winning percentage in taxpaying seasons: 60.3 percent

Winning percentage in non-taxpaying seasons: 49.2 percent

The Oklahoma City Thunder paid a large amount of tax in a short amount of time in the last few Russell Westbrook years. During the 2017-18 and 2018-19 seasons, the Thunder paid $87 million in penalties. Their willingness to spend then could be an indicator that ownership will be willing to invest in their current group if they become contenders.

Phoenix Suns

Total penalties: $69,069,147

Taxpaying seasons: 5

Average tax penalty: $13,813,829

Winning percentage in taxpaying seasons: 59.5 percent

Winning percentage in non-taxpaying seasons: 47.5 percent

The Phoenix Suns only paid the tax a handful of times during the Steve Nash years. Out of their $69 million in penalties, most of it came from the $53.4 million they spent in 2022-23. They are currently projected to pay that amount again this upcoming season.

Miami Heat

Total penalties: $52,903,034

Taxpaying seasons: 7

Average tax penalty: $7,557,576

Winning percentage in taxpaying seasons: 54.6 percent

Winning percentage in non-taxpaying seasons: 51.4 percent

It feels like the Miami Heat have been taxpayers in more seasons but they’ve only paid the tax once since acquiring Jimmy Butler. The majority of their penalties came from fielding their rosters featuring LeBron James, Dwyane Wade, and Chris Bosh. They are likely to be taxpayers over the next few seasons, especially if they successfully acquire Damian Lillard.

Philadelphia 76ers

Total penalties: $47,312,042

Taxpaying seasons: 4

Average tax penalty: $11,828,011

Winning percentage in taxpaying seasons: 57.3 percent

Winning percentage in non-taxpaying seasons: 44.2 percent

The Philadelphia 76ers have mostly stayed out of the tax with the exception of a couple of Ben Simmons seasons. They avoided the tax last year and will likely look to get below it before this season ends. If they could finally reach the Eastern Conference Finals again, something they haven’t done since 2001, perhaps they would be willing to be taxpayers.

Orlando Magic

Total penalties: $39,951,508

Taxpaying seasons: 3

Average tax penalty: $12,983,836

Winning percentage in taxpaying seasons: 59.8 percent

Winning percentage in non-taxpaying seasons: 42.4 percent

The Orlando Magic have mostly stayed out of the tax with the exception of a couple of Dwight Howard years. They spent $31 million in penalties between the 2009-10 and 2010-11 seasons following their trip to the NBA Finals.

Denver Nuggets

Total penalties: $38,459,952

Taxpaying seasons: 4

Average tax penalty: $9,614,988

Winning percentage in taxpaying seasons: 61.3 percent

Winning percentage in non-taxpaying seasons: 53.1 percent

The Denver Nuggets have mostly stayed out of the tax with the exception of a few seasons in which they showed signs of being a contender. They paid a modest $17.3 million payment in their 2022-23 title season and will likely look to keep expenses fixed at that range over the next few seasons.

Toronto Raptors

Total penalties: $31,962,799

Taxpaying seasons: 3

Average tax penalty: $10,654,266

Winning percentage in taxpaying seasons: 46.7 percent

Winning percentage in non-taxpaying seasons: 51.3 percent

The Toronto Raptors paid most of their penalties in their 2018-19 championship season with a $25.2 million penalty. Other than that year, they have mostly stayed away from spending that much. If the roster shows championship potential again, ownership will likely give the green light to get into the tax.

Utah Jazz

Total penalties: $30,854,022

Taxpaying seasons: 4

Average tax penalty: $7,713,506

Winning percentage in taxpaying seasons: 61.1 percent

Winning percentage in non-taxpaying seasons: 54.1 percent

The Utah Jazz have historically stayed out of the tax but showed a willingness to spend in recent seasons. The majority of their penalties came from the final Donovan Mitchell and Rudy Gobert years when they had strong regular-season performances.

Sacramento Kings

Total penalties: $30,518,745

Taxpaying seasons: 2

Average tax penalty: $15,259,373

Winning percentage in taxpaying seasons: 69.6 percent

Winning percentage in non-taxpaying seasons: 41 percent

The Sacramento Kings have avoided the tax in all but the first two seasons since it system got started. Thankfully, they had strong regular season performances in them despite not reaching the Conference Finals again. They seem unlikely to reenter the tax anytime soon.

Minnesota Timberwolves

Total penalties: $25,155,044

Taxpaying seasons: 4

Average tax penalty: $6,288,761

Winning percentage in taxpaying seasons: 50.4 percent

Winning percentage in non-taxpaying seasons: 37.2 percent

The Minnesota Timberwolves have only been in the tax in the early 2000s when Kevin Garnett was making over $25 million annually. They seem unlikely to be big spenders in the future even if the team becomes a true contender. They are already facing a tax crunch for next season that could force them to trade one of their highest-paid players, like Karl–Anthony Towns.

San Antonio Spurs

Total penalties: $17,513,321

Taxpaying seasons: 6

Average tax penalty: $2,918,887

Winning percentage in taxpaying seasons: 73.2 percent

Winning percentage in non-taxpaying seasons: 60.1 percent

The San Antonio Spurs have a small amount in tax payments relative to their success. They’ve only paid the tax in two of their championship seasons spending a combined $383,000 in them, making them one of the most efficient taxpayers in league history. It’s unclear if they’ll be willing to be big spenders in the future since their biggest tax payment was just $8.8 million.

Memphis Grizzlies

Total penalties: $11,297,452

Taxpaying seasons: 2

Average tax penalty: $5,648,726

Winning percentage in taxpaying seasons: 47 percent

Winning percentage in non-taxpaying seasons: 50.4 percent

The Memphis Grizzlies have only paid the tax in two Pau Gasol seasons. They’ve stayed out of it since 2006, but are set to become taxpayers over the next few seasons. After extending Desmond Bane, they’re projected to have a penalty in the $50 million range in 2024-25.

Indiana Pacers

Chicago Bulls

Total penalties: $8,130,677

Taxpaying seasons: 2

Average tax penalty: $4,065,339

Winning percentage in taxpaying seasons: 53.1 percent

Winning percentage in non-taxpaying seasons: 48.7 percent

The Chicago Bulls have been mostly mediocre since the implementation of the tax, leaving little reason to spend that much. They only paid the tax twice during the Derrick Rose years, and they may have had more seasons in the tax had he not gotten injured.

Washington Wizards

Houston Rockets

Total penalties: $5,632,243

Taxpaying seasons: 2

Average tax penalty: $2,816,122

Winning percentage in taxpaying seasons: 51.2 percent

Winning percentage in non-taxpaying seasons: 54.6 percent

The Houston Rockets have historically stayed away from the tax since its implementation. One of the more fun cap-nerdy things in recent years is watching how they climbed their way out of the tax in the final James Harden years. Even if they become a contender again, it seems unlikely they’ll want to be taxpayers at all.

Atlanta Hawks

Total penalties: $4,382,199

Taxpaying seasons: 2

Average tax penalty: $2,191,100

Winning percentage in taxpaying seasons: 51.7 percent

Winning percentage in non-taxpaying seasons: 47.8 percent

The Atlanta Hawks have stayed out of the tax for all but two seasons. They have been managing a tax crunch for a couple of years since Trae Young‘s maximum deal kicked in. They could be looking to shed more high-paying veterans to make room for extensions for their young players.

Detroit Pistons

Total penalties: $756,627

Taxpaying seasons: 1

Average tax penalty: $756,627

Winning percentage in taxpaying seasons: 65.9 percent

Winning percentage in non-taxpaying seasons: 44.4 percent

The Detroit Pistons have been strangers to the tax for all but one season – their 2003-04 championship season. They had one of the smallest payments and converted on a title, making them the most efficient taxpayers. Hopefully, they get to a place soon competitively where it will make sense to get into the tax.

Yahoo Sports

Yahoo Sports