Some Investors May Be Worried About Velesto Energy Berhad's (KLSE:VELESTO) Returns On Capital

When researching a stock for investment, what can tell us that the company is in decline? More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. And from a first read, things don't look too good at Velesto Energy Berhad (KLSE:VELESTO), so let's see why.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Velesto Energy Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0077 = RM20m ÷ (RM3.1b - RM541m) (Based on the trailing twelve months to March 2023).

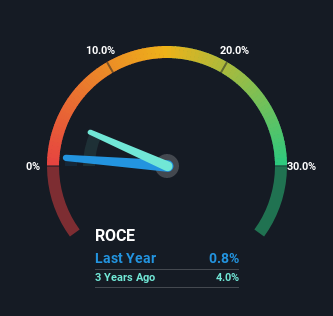

So, Velesto Energy Berhad has an ROCE of 0.8%. Ultimately, that's a low return and it under-performs the Energy Services industry average of 7.8%.

View our latest analysis for Velesto Energy Berhad

Above you can see how the current ROCE for Velesto Energy Berhad compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Velesto Energy Berhad.

What The Trend Of ROCE Can Tell Us

In terms of Velesto Energy Berhad's historical ROCE trend, it isn't fantastic. Unfortunately, returns have declined substantially over the last five years to the 0.8% we see today. What's equally concerning is that the amount of capital deployed in the business has shrunk by 35% over that same period. When you see both ROCE and capital employed diminishing, it can often be a sign of a mature and shrinking business that might be in structural decline. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 17%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.

Our Take On Velesto Energy Berhad's ROCE

To see Velesto Energy Berhad reducing the capital employed in the business in tandem with diminishing returns, is concerning. Long term shareholders who've owned the stock over the last five years have experienced a 17% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

If you want to continue researching Velesto Energy Berhad, you might be interested to know about the 2 warning signs that our analysis has discovered.

While Velesto Energy Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Sports

Yahoo Sports