Introducing Leonteq (VTX:LEON), The Stock That Tanked 78%

While not a mind-blowing move, it is good to see that the Leonteq AG (VTX:LEON) share price has gained 14% in the last three months. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 78% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Check out our latest analysis for Leonteq

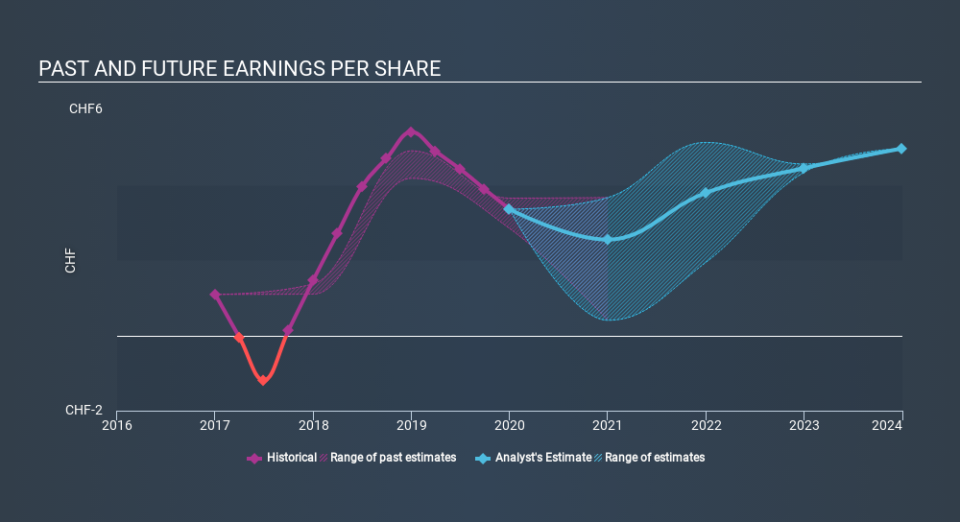

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Looking back five years, both Leonteq's share price and EPS declined; the latter at a rate of 5.2% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 26% per year, over the period. This implies that the market is more cautious about the business these days. The low P/E ratio of 11.30 further reflects this reticence.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Leonteq has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We've already covered Leonteq's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Leonteq's TSR of was a loss of 76% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Leonteq shareholders have received a total shareholder return of 2.5% over one year. That's including the dividend. Notably the five-year annualised TSR loss of 25% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Leonteq better, we need to consider many other factors. For instance, we've identified 2 warning signs for Leonteq that you should be aware of.

We will like Leonteq better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Sports

Yahoo Sports