How IC Capitalight Corp. (CSE:IC) Can Impact Your Portfolio Volatility

If you're interested in IC Capitalight Corp. (CSE:IC), then you might want to consider its beta (a measure of share price volatility) in order to understand how the stock could impact your portfolio. Volatility is considered to be a measure of risk in modern finance theory. Investors may think of volatility as falling into two main categories. The first type is company specific volatility. Investors use diversification across uncorrelated stocks to reduce this kind of price volatility across the portfolio. The second sort is caused by the natural volatility of markets, overall. For example, certain macroeconomic events will impact (virtually) all stocks on the market.

Some stocks are more sensitive to general market forces than others. Beta can be a useful tool to understand how much a stock is influenced by market risk (volatility). However, Warren Buffett said 'volatility is far from synonymous with risk' in his 2014 letter to investors. So, while useful, beta is not the only metric to consider. To use beta as an investor, you must first understand that the overall market has a beta of one. Any stock with a beta of greater than one is considered more volatile than the market, while those with a beta below one are either less volatile or poorly correlated with the market.

View our latest analysis for IC Capitalight

What we can learn from IC's beta value

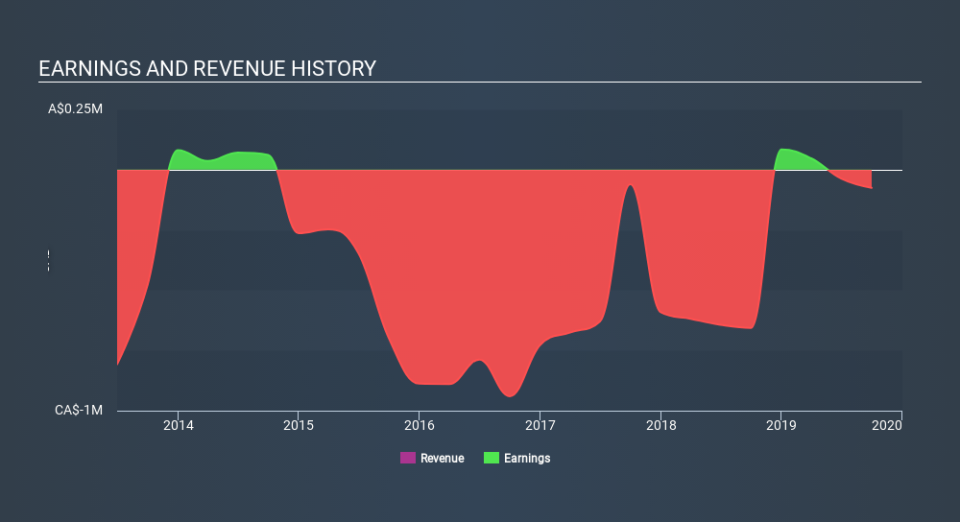

Given that it has a beta of 1.97, we can surmise that the IC Capitalight share price has been fairly sensitive to market volatility (over the last 5 years). Based on this history, investors should be aware that IC Capitalight are likely to rise strongly in times of greed, but sell off in times of fear. Many would argue that beta is useful in position sizing, but fundamental metrics such as revenue and earnings are more important overall. You can see IC Capitalight's revenue and earnings in the image below.

How does IC's size impact its beta?

IC Capitalight is a noticeably small company, with a market capitalisation of CA$1.3m. Most companies this size are not always actively traded. It takes less money to influence the share price of a very small company. This may explain the excess volatility implied by this beta value.

What this means for you:

Beta only tells us that the IC Capitalight share price is sensitive to broader market movements. This could indicate that it is a high growth company, or is heavily influenced by sentiment because it is speculative. Alternatively, it could have operating leverage in its business model. Ultimately, beta is an interesting metric, but there's plenty more to learn. This article aims to educate investors about beta values, but it's well worth looking at important company-specific fundamentals such as IC Capitalight’s financial health and performance track record. I urge you to continue your research by taking a look at the following:

Past Track Record: Has IC been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of IC's historicals for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Sports

Yahoo Sports