Here's Why We Think Esquire Financial Holdings (NASDAQ:ESQ) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Esquire Financial Holdings (NASDAQ:ESQ), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Esquire Financial Holdings

Esquire Financial Holdings's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Esquire Financial Holdings has grown EPS by 47% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

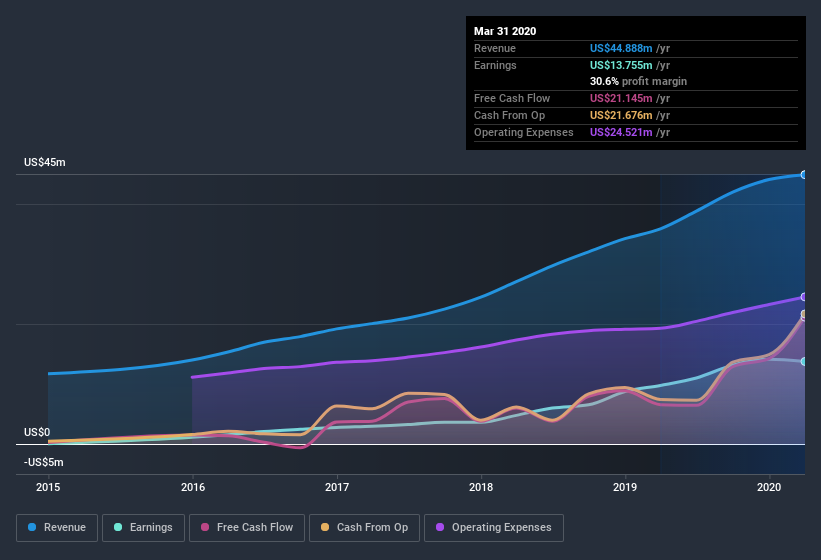

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Esquire Financial Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Esquire Financial Holdings's EBIT margins were flat over the last year, revenue grew by a solid 25% to US$45m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Esquire Financial Holdings isn't a huge company, given its market capitalization of US$124m. That makes it extra important to check on its balance sheet strength.

Are Esquire Financial Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent US$883k buying Esquire Financial Holdings shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Independent Director Kevin Waterhouse who made the biggest single purchase, worth US$131k, paying US$23.45 per share.

The good news, alongside the insider buying, for Esquire Financial Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$18m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 14% of the company; visible skin in the game.

Does Esquire Financial Holdings Deserve A Spot On Your Watchlist?

Esquire Financial Holdings's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Esquire Financial Holdings belongs on the top of your watchlist. You still need to take note of risks, for example - Esquire Financial Holdings has 1 warning sign we think you should be aware of.

The good news is that Esquire Financial Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Sports

Yahoo Sports