Disney Slams Activist Investor Peltz as ‘Disruptive and Destructive,’ Says His Proxy Fight ‘Seems More About Vanity Than a Belief’ in Company

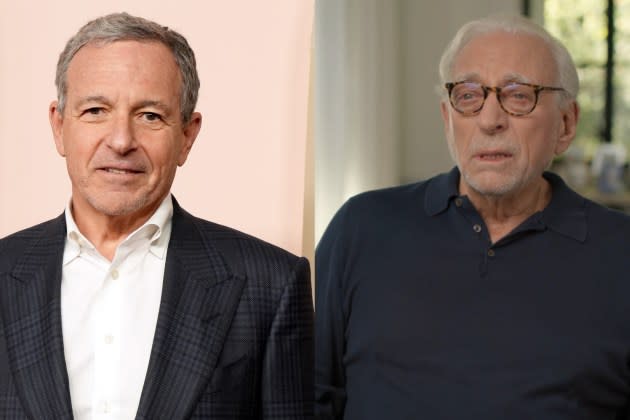

Disney came out swinging in its most strongly worded denunciation yet of Nelson Peltz and the activist investor’s bid to grab two seats on the Mouse House’s board.

In a video posted Monday to its shareholder campaign site (votedisney.com), Disney labeled the proxy fight waged by Peltz’s Trian Partners “disruptive and destructive.” Trian is urging Disney investors to vote in Peltz and Jay Rasulo, former CFO at Disney, at the company’s April 3 annual shareholders meeting.

More from Variety

If Peltz and Rasulo succeed in getting seats on Disney’s board, “Disney could suffer the same fate as other great companies that Peltz has previously infiltrated, such as GE and DuPont,” a narrator intones in the nearly three-minute video released by Disney. “Nelson Peltz has a long history of attacking companies to the ultimate detriment of shareholder value.”

Peltz’s “quest also seems more about vanity than a belief in Disney,” the company alleges in the video. “Why else would he sell 500,000 Disney shares over the past six months in the middle of his proxy fight?”

The video goes on to point out that Peltz admits he has no experience running a global media company (excerpting a clip of a Peltz interview in CNBC in which he said, “They said I have no media experience — I don’t claim to have any”). Regarding Rasulo, who was Disney’s CFO from 2010-15, the video calls him “a former employee who was passed over for a promotion nearly a decade ago” and says “the last time [Rasulo] joined the board of a media company” — iHeartMedia — “the stock tanked.”

In response, a Trian spokesperson said in a statement sent to Variety: “The recent Disney video contains false and misleading statements designed to divert from Disney’s poor performance over many years. To suggest that Nelson Peltz is an ‘infiltrator’ (he has been elected overwhelmingly by shareholders in 48 elections) is offensive and highly dismissive of shareholder democracy.”

The Disney video — which is produced in the style of a political attack ad — also says Peltz and Rasulo have teamed up with ex-Marvel chairman Ike Perlmutter, a “former disgruntled employee… who has his own lengthy record of destructive behavior inside Disney.” About 79% of the shares claimed to be beneficially owned by Trian are owned by Perlmutter. The video reiterates the company’s assertion that Perlmutter nurses a longstanding personal grudge against Disney CEO Bob Iger: “This sort of personal animus in the boardroom is more than disruptive — it can be destructive.”

“The Walt Disney Co. has turned a corner and is focused on creating lasting, long-term value,” the video says. Among the points cited: Disney’s board has authorized $3 billion in stock repurchases in fiscal year 2024 and increased the cash dividend to shareholders to 45 cents/share payable in July (up 50% from the January dividend). The video also cites Disney’s $1.5 billion investment in Epic Games, the fall 2024 release of “Moana 2” and the March 14 release of “Taylor Swift’s Eras Tour (Taylor’s Version)” on Disney+.

In a recent letter to Disney investors, Trian said, “Shareholders can’t afford another boom-and-bust sequel.” The hedge fund acknowledged, “After 10 years of poor performance, Disney’s stock is up in the first two months of 2024.” Year to date, the price of Disney shares has increased 24%. But Trian’s letter questioned whether the company can execute on recent announced strategic plans and said that “without the pressure of our proxy contest pushing Disney to perform, it is unclear if the ‘announcements’ would have been made.”

While Disney claims that “it has now, finally and suddenly (as the proxy vote is looming) ‘turned the corner and entered a new era,’ we are skeptical that the same people who directed Disney’s story for the last 10 years will suddenly produce a hit,” Trian said in the letter.

Iger, at an investment conference last week, commented about Peltz’s proxy fight, “This campaign is designed to distract us. I am working really hard to not let this distract me, because when I get distracted everybody who works for me gets distracted, and that’s not a good thing.”

Disney’s shareholder campaign site also posted two letters from grandkids of Walt Disney and his brother Roy O. Disney, who criticized the activist investor firms and threw their support behind Iger and the current board.

Meanwhile, Peltz’s Trian on March 4 released a lengthy white paper detailing strategic changes the hedge fund argues will improve Disney’s financial performance and boost its stock price. Among its suggestions: Disney should revamp its streaming-content strategy to take “more shots on goal”; consolidate Disney+ and Hulu operations; and produce fewer movie sequels. Trian also wants Disney’s board to “fix” the company’s “chronic succession problems” for the 73-year-old Iger, whose renewed CEO contract expires at the end of 2026.

Regarding Trian’s white paper, Disney claims in the new video that it includes a “surprising number of questionable proposals that reinforces clear lack of experience in media” as well as several suggestions Disney is already implementing.

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Sports

Yahoo Sports