Coronavirus: BP forecasts persistent impact on economic activity and energy demand

Coronavirus will have a persistent impact on economic activity and the energy sector, as well as driving behaviour changes.

According to a new report by BP (BP.L), the fallout from the coronavirus pandemic in the long-term could mean that people travel less, switch from using public transport to other modes of travel, or work from home more frequently.

“Many of these behavioural changes are likely to dissipate over time as the pandemic is brought under control and public confidence is restored. But some changes, such as increased working from home, may persist,” it says.

BP’s 10th annual report on the future of energy, which was published on Monday, explores three scenarios, looking as far ahead as 2050.

“Rapid” assumes carbon emissions from energy use will fall by around 70% by 2050; “Net-Zero” looks to a scenario where global carbon emissions from energy use fall by over 95% by 2050 and “Business as Usual” points to the outcome where the pace of change echoes the recent past.

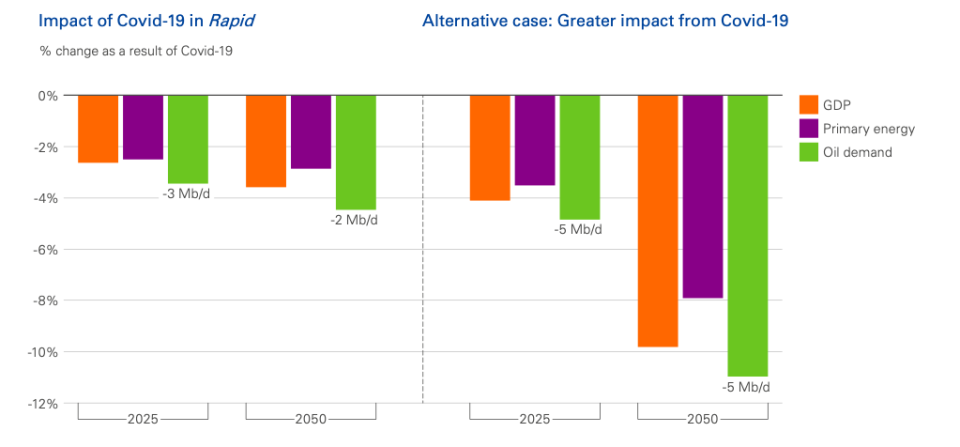

“There is a risk that the economic losses from COVID-19 may be significantly bigger, especially if there are further waves of infection,” the report reads.

Notably, BP projects global oil demand may have passed peak levels, pointing to scenarios where it has been replaced by clean electricity from windfarms, solar panels and hydropower plants as renewable energy emerges as the fastest-growing energy source on record.

In last year’s report the base case expected oil consumption to grow over the next decade, reaching a peak in the 2030s.

“This year’s Outlook has been instrumental in the development of the new strategy we announced in August,” a note from Bernard Looney, BP CEO reads at the start of the report.

The change in strategy assumes renewable energy will play an increasing role in energy demand; that customers will “redefine mobility and convenience, underpinned by the mobility revolution that is already underway combining electric vehicles, shared mobility and autonomy,” and “oil and gas – while remaining needed for decades – will be increasingly challenged as society shifts away from its reliance on fossil fuels.”

READ MORE: Stocks rise as AstraZeneca resumes vaccine trial

Some analysts are less convinced by the viability of this new strategy pivot.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown said: ”As difficult steps go, BP’s pirouette from traditional oil company to green energy giant ranks among the more challenging.

“The company still produces 2.6 million barrels of oil a day, and making an abrupt heel-turn away from its core business towards renewables could see investors used to steady returns, leaving their seats and heading for the exit.

“The CEO Bernard Looney has been trying to perfect the complex move of reassuring them he is not abandoning oil and gas, while demonstrating the huge potential of renewable energy,” she said.

The near 10% slump in demand for oil this year has left investors and companies guessing how big a change the industry will see. The three scenarios laid out by BP suggest their new strategy will have to be radical under a net-zero scenario.

Yahoo Sports

Yahoo Sports