California Democrats have long failed to tax guns, ammunition. Could this year be different?

California Democrats have long struggled make headway on one gun safety measure: a state excise tax on firearms and ammunition.

Gun control advocates say 2023 could be the year legislators finally make it happen.

Lawmakers have tried at least six times in the last 10 years to tax guns and ammunition in some form. Assemblyman Jesse Gabriel, D-Woodland Hills, picked up the mantle this year by authoring Assembly Bill 28.

It would levy an 11% state excise tax on sales from firearm and ammunition dealers, manufacturers and vendors. The estimated $159 million in revenue for 2024-2025 would fund violence prevention programs.

AB 28 has advanced further than any previous measures. The bill is currently parked in the Senate Appropriations Committee’s suspense file, where it will remain until the panel takes it up before the end of the month.

The next stop would be the Senate floor for final consideration before heading to Gov. Gavin Newsom’s desk.

Violence prevention groups are cheering the measure’s progress, even as firearm owner organizations worry it could negatively impact sporting and price out individuals looking to purchase guns for their safety.

The federal government already levies excise taxes of 10 to 11% on guns and bullets, with the proceeds going to fund wildlife conservation programs. If California lawmakers were to pass a tax, the state would join a group of local governments that add their own on top of the one paid nationally.

Gabriel attributes some of the bill’s success to parental anxiety about child safety in an era plagued by mass shootings — many of them at schools.

“I think if you talk to a lot of moms and dads out there, irrespective of whether they were Democrats or Republicans, (they) would be concerned about having their kids be safe in school and would want to do more to stop cycles of violence in our communities,” Gabriel said.

Multiple gun tax attempts

Prior to Gabriel, at least four other lawmakers attempted to pass similar bills taxing firearms or ammunition.

Former Assemblyman Roger Dickinson, D-Sacramento, authored a bill during the 2013-2014 legislative session that would have levied a 5-cent-per-bullet tax. That same year, now-Attorney General Rob Bonta — then an Oakland assemblyman — promoted a measure that would have taxed ammunition at 10%.

In 2018, former Elk Grove Assemblyman Jim Cooper, now Sacramento County sheriff, proposed a tax on gross receipts from all firearm and ammunition sales.

All three bills died in committees.

Former Assemblyman Marc Levine, D-San Rafael, tried at least three times to pass a state excise tax on guns and ammunition. The first, in 2018, would have created a $25-per-firearm retailer tax. That bill was held in the Assembly Appropriations Committee.

His second and third bills would have levied a 10-to-11% tax on guns and ammunition. A 2021 measure failed in the Assembly and missed a deadline to advance to the Senate.

Levine later gutted a bill that had already advanced to the Senate and amended it into a gun tax. It failed on the Senate floor in August 2022.He opted not to run for a final Assembly term in favor of making a failed bid for insurance commissioner.

A path to success?

Levine said he sees more of a path for the bill this year, when the state is facing a $31.5 billion budget gap and people feel the need for more violence prevention funding.

Californians and lawmakers have also had time to consider the gun tax, Levine said, and some new legislators may be friendlier to the concept because their districts became more blue in 2020.

“I think the other thing that happened was we had redistricting,” he said. “Some seats that members that may not have felt comfortable voting for this bill now did feel comfortable voting for the bill.”

Gabriel was able to win over some moderate Democrats who did not vote for Levine’s bill, including San Diego-area Assemblywoman Tasha Boerner and Irvine Assemblywoman Cottie Petrie-Norris.

Like all tax measures, AB 28 will require a two-thirds vote in the Assembly and Senate. Gabriel received 56 votes in the Assembly, two more than he needed. It will need 27 senators for legislative approval.

Gabriel said he talked to every Assembly member prior to the April floor hearing and knew how everyone would vote. He plans to do the same in the Senate.

“We do feel that this is the year,” he said. “I think we’re cautiously optimistic. We’re taking nothing for granted. We’re going to continue to work.”

Tax advocates and opposition

Gun owner groups continue to actively oppose AB 28, saying dealers and manufacturers will pass the tax on to consumers and penalize law-abiding gun owners who want to use firearms for sports or protection.

“If you look at our community, we have the safest record with firearms,” said Rick Travis, legislative director for the California Rifle and Pistol Association. “We’re the ones that promote firearm safety. And, ironically, this author has never asked any of us in our industry to meet him at the table and say, ‘How can we make things safer?’”

Travis wants to see more money go to the state Department of Justice’s Armed and Prohibited Persons System, which is supposed to take guns away from people convicted of crimes that keep them from owning firearms. But the system has a backlog of 23,000 to 24,000 cases.

Travis sees AB 28 coming down to the last couple of weeks of session, as “both sides. are working very, very hard on this bill.”

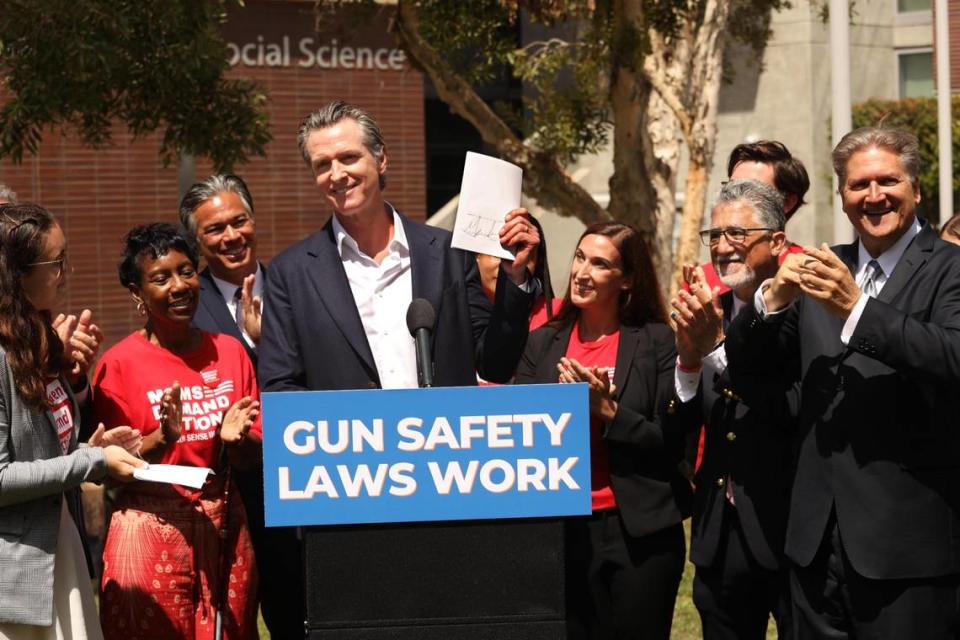

Organizers from Everytown for Gun Safety and Moms Demand Action for Gun Sense in America say they have seen significant numbers of volunteers coming to the Capitol to attend bill committee hearings.

“We had all kinds of people coming together saying, ‘We want this bill. We want this bill to pass,” said Cassandra Whetstone of Moms Demand Action. “That’s what makes this one so different: we’re seeing this turnout.”

The fact that the bill will directly fund violence prevention efforts has played a role in the enthusiasm, said Renia Webb, also of Moms Demand Action.

“I think that’s what’s really got even people showing up at the hearings, making the calls,” Webb said. “Because it does have a direct impact. Sometimes if you don’t see where the money goes, or you don’t understand, it’s a lot of jargon sometimes. But it just makes it very simple.”

Yahoo Sports

Yahoo Sports