Some Analysts Just Cut Their Viela Bio, Inc. (NASDAQ:VIE) Estimates

One thing we could say about the analysts on Viela Bio, Inc. (NASDAQ:VIE) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. The stock price has risen 7.4% to US$50.70 over the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

Following the latest downgrade, the current consensus, from the six analysts covering Viela Bio, is for revenues of US$18m in 2020, which would reflect a disturbing 65% reduction in Viela Bio's sales over the past 12 months. Losses are predicted to fall substantially, shrinking 54% to US$3.21. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$22m and losses of US$3.01 per share in 2020. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Check out our latest analysis for Viela Bio

Analysts lifted their price target 15% to US$60.40, implicitly signalling that lower earnings per share are not expected to have a longer-term impact on the stock's value. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Viela Bio at US$78.00 per share, while the most bearish prices it at US$36.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Viela Bio. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given the stark change in sentiment, we'd understand if investors became more cautious on Viela Bio after today.

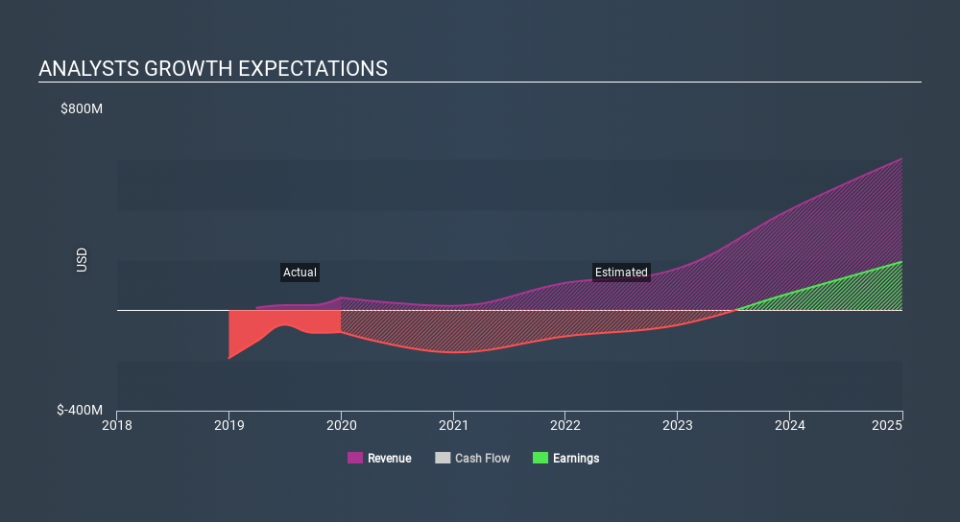

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Viela Bio going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Sports

Yahoo Sports