Why Britain’s electric cars risk driving into a ‘massive black hole’

The Government is pushing drivers to go electric to meet its net zero targets – yet as it solves one problem, another moves into view.

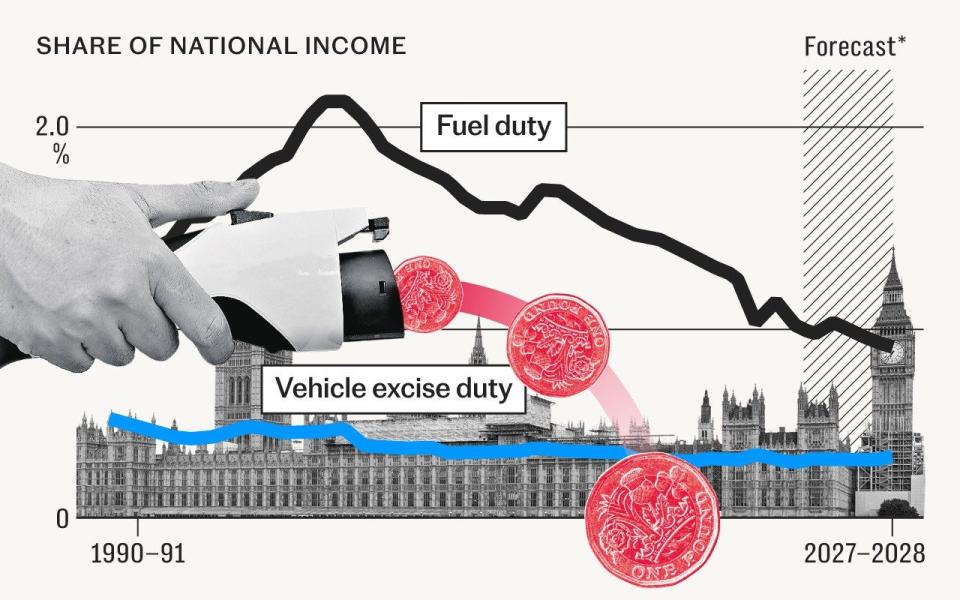

Fuel duty currently earns the Exchequer £24.3bn a year, which is equivalent to nearly 2.3pc of the total tax take. When other taxes on car ownership are included, the total earned from drivers rises to £32bn.

Killing off the combustion engine means missing out on these revenues as the electricity used to charge up electric cars is not taxed in the same way as petrol or diesel.

The looming loss of fuel duty means the Treasury will face a “massive black hole” – a £10bn budget deficit – by the early 2030s, according to new analysis by the Resolution Foundation.

The Government must find a way to fill the black hole and quickly – or else other taxes will need to rise or spending be cut.

How to fill the gap? The Resolution Foundation is pushing for a road tax of 6p-per-mile on electric vehicles (EVs).

The influential think tank argues that the levy would help meet the Government’s shortfall while also keeping electric cars cheaper to run than petrol or diesel equivalents.

Electric cars are currently 60pc cheaper to run than petrol and diesel vehicles and a 6p-a-mile tax would still leave them 20pc below that of a typical fossil fuel car.

GPS trackers in EVs could be used to measure the distance travelled and would make it possible to collect road tax monthly, according to the proposal.

Yet a shift to a “pay-as-you-drive” model of car tax that involves snooping on your daily movements would be a radical departure that is likely to alarm both the auto industry and privacy advocates.

Car manufacturers have already warned that a reduction of tax breaks for EV purchases has dented sales and Steve Gooding, director of the RAC Foundation, says policymakers need to be careful not to put people off further.

“We hear motor industry chiefs reporting people switching back to petrol and diesel vehicles because they are easier to use,” he says.

“Huge swings in electricity prices have left people unsure about the running cost advantages of switching.

“Introduction of a per-mile charge for EV drivers could risk slamming the drive away from fossil fuels into reverse.”

Jonny Marshall, an economist at the Resolution Foundation, argues that the fact EVs will still have lower running costs reduces the risk of discouraging people from purchasing greener vehicles.

However, recent buying patterns suggest that drivers are fickle and finely tuned to movements in relative cost.

The think tank is not the first to propose a “pay-as-you-drive” tax and, despite reservations among industry, the idea has gained traction on both sides of the political divide.

The Transport Committee, which is chaired by Conservative MP Iain Stewart, recommended replacing fuel duty and vehicle excise duty with a new road tax in a recent report.

The committee warned that the Treasury would face a shortfall of as much as £35bn without action.

Greg Smith, Conservative MP for Buckingham, says it’s “inevitable” that the Treasury will face a “black hole” given the ban on sales of new petrol and diesel vehicles coming into force from 2030.

As a result, Smith, who is vice chairman of the All-Party Parliamentary Group For Better Roads, believes fundamental reform is needed.

He argues that a road tax should be introduced for all cars, not just EVs as the Resolution Foundation has suggested.

“Personally, I prefer to see all motorists treated equally when it comes to the way they’re taxed to drive on the UK roads,” he says.

“At the end of the day, an electric vehicle needs the same space and does the same damage to the tarmac as a petrol or diesel vehicle. So it’s only fair that battery electric vehicle drivers pay their fair share for maintaining the UK’s road network and capacity.”

While the Labour Party is yet to make clear where they stand on the issue, the proposal appears popular with the party’s MPs.

Clive Betts, a Labour MP for Sheffield South East who chairs the Levelling Up Select Committee, says: “I think we’ve got to give serious thought to it.

“No new tax is ever going to be popular but I think most people intuitively can see that something has to be done because if you don’t tax driving in some form then you’ve got to tax something else.”

The idea is likely to be an easier sell for a Labour Government than a Conservative one: the opposition party’s voters tend to be younger, more urban and less likely to drive.

Labour’s Sadiq Khan has already shown the party is willing to take a highly interventionist and unpopular stance on motoring through Ulez, the emissions charging scheme he has introduced as London Mayor.

A road tax would be a far tougher sell for Conservative voters, who are more likely to live in rural and suburban areas where they are heavily reliant on their cars.

Many drivers are already unhappy about being forced to switch to electric, particularly given the paltry charging infrastructure in many areas.

In the worst-served areas of the UK, the ratio of electric vehicles to public charging points is as high as one to 85, according to recent analysis.

“It’s a joke what we have in the UK at present and I think people will get more and more angry if they have to pay,” Betts says.

On a practical level, implementing a road tax that relies on GPS trackers also raises issues around privacy. Drivers may feel concerned about the government collecting so much information on their whereabouts, not to mention who handles that data and how securely it is stored.

The Treasury has rejected the idea of a road tax for now.

A spokesman told the Telegraph that changes to vehicle excise duty, which will see electric car owners forced to pay the duty for the first time from 2025, would ensure that “all drivers start to make a fair tax contribution.”

“We are making sure that motoring tax revenues keep pace with the switch to electric vehicles, whilst keeping it affordable for consumers, and have no plans to introduce road pricing,” the spokesman said.

That line may not hold for much longer. Whoever holds the keys to Number 11 after the next general election will have to solve the electric car tax conundrum or face unpleasant decisions elsewhere.

Yahoo Sports

Yahoo Sports