Walmart (WMT) Readies for Q2 Earnings: Key Things to Note

Walmart Inc. WMT is likely to register top-line growth when it reports second-quarter fiscal 2023 earnings on Aug 16. The Zacks Consensus Estimate for quarterly revenues is pegged at $151.4 billion, suggesting a rise of 7.4% from the prior-year quarter’s reported figure.

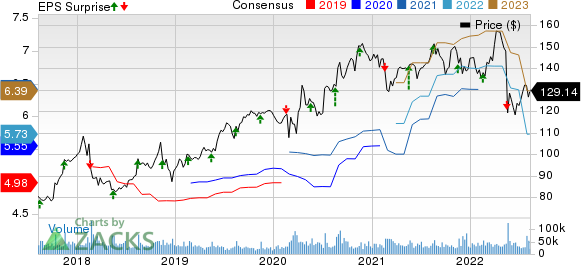

However, the bottom line is likely to have declined year over year. The Zacks Consensus Estimate for quarterly earnings has declined 12.1% in the past 30 days to $1.60 per share, indicating a 10.1% decline from the figure reported in the prior-year quarter. The supermarket giant has a trailing four-quarter earnings surprise of 2.4%, on average. WMT delivered a negative earnings surprise of around 11% in the last reported quarter.

Cost Headwinds to Linger

Walmart is grappling with supply-chain bottlenecks. The company’s consolidated gross profit margin contracted by 87 basis points (bps) in the last reported quarter, primarily due to Sam’s Club, wherein the gross margin fell 219 bps. This was due to supply-chain costs, a fuel mix, inflation and markdowns stemming from the delayed inventory. On its first-quarter earnings call, management stated that it expects the gross margin to remain under pressure in the second quarter, though it is likely to improve sequentially.

Apart from this, SG&A costs escalated by 39 bps as a percentage of sales in the first quarter due to higher wage costs in Walmart U.S. Consolidated operating expenses as a percentage of sales increased by 45 bps year over year, stemming mainly from elevated wage costs in Walmart U.S. Some of the cost headwinds are likely to have persisted in the second quarter. These factors raise concerns for the quarter under review.

Walmart Inc. Price, Consensus and EPS Surprise

Walmart Inc. price-consensus-eps-surprise-chart | Walmart Inc. Quote

Sales Picture Looks Favorable

Walmart has been benefiting from its efforts to strengthen store and online operations. It has been undertaking several efforts to enhance merchandise assortments. Also, the company has been focused on store remodeling to upgrade them with advanced in-store and digital innovations. The company’s compelling pricing strategy has been helping it draw customers.

Walmart’s e-commerce growth efforts, especially steps to enhance delivery services, have been working well. The company has taken robust strides to strengthen its delivery arm, as evident from its deal with Canoo, an expansion of the InHome delivery service, investment in DroneUp, a pilot with HomeValet, the introduction of Carrier Pickup by FedEx, the launch of the Walmart+ membership program, drone delivery pilots in the United States with Flytrex and Zipline and a pilot with Cruise to test grocery delivery through self-driven all-electric cars.

Before this, Walmart unveiled Express Delivery and joined forces with Point Pickup, Roadie and Postmates alongside acquiring Parcel to enhance its delivery service. Furthermore, the company’s store and curbside pickup options add to customers’ convenience. As of the first quarter of fiscal 2023, Walmart U.S. had 4,600 pickup locations and more than 3,600 same-day delivery stores.

Apart from this, WMT is innovating in the supply chain and adding capacity as well as building businesses, such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+, Spark Delivery, Marketplace and Walmart Fulfillment Services.

The Zacks Consensus Estimate for second-quarter sales at Walmart U.S. is pegged at $104.3 billion compared with the $98.2 billion reported in the year-ago period. The consensus mark for Walmart International and Sam’s Club currently stands at $24.1 billion and $21.7 billion, respectively, up from around $23 billion and the $18.6 billion reported in the same period last year.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for Walmart this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here.

Walmart carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat.

Dollar General DG currently has an Earnings ESP of +0.99% and a Zacks Rank #2. DG is expected to register top and bottom-line growth when it reports second-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for Dollar General’s quarterly revenues is pegged at $9.4 billion, which suggests growth of 8.4% from the prior-year quarter’s reported figure. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dollar General’s quarterly earnings has moved a penny up in the past seven days to $2.92 per share, suggesting an improvement of 8.6% from the year-ago quarter’s tally. DG delivered an earnings beat of 2.8%, on average, in the trailing four quarters.

Ulta Beauty ULTA currently has an Earnings ESP of +3.27% and a Zacks Rank #2. The company is likely to register a bottom-line improvement when it reports second-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $4.84 suggests an improvement from the $4.56 reported in the year-ago quarter.

Ulta Beauty's top line is also expected to have risen year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.2 billion, which indicates an improvement of 11.7% from the figure reported in the prior-year quarter. ULTA has a trailing four-quarter earnings surprise of 49.8%, on average.

Ollie's Bargain Outlet OLLI currently has an Earnings ESP of +6.06% and a Zacks Rank of 2. The company is likely to register a rise in the top line when it reports second-quarter fiscal 2022 results. The Zacks Consensus Estimate for OLLI’s quarterly revenues is pegged at $457.5 million, which suggests a jump of 10% from the figure reported in the prior-year quarter.

The consensus mark for Ollie's Bargain’s quarterly earnings has remained unchanged at 33 cents per share in the past 30 days. The consensus estimate for OLLI’s quarterly earnings suggests a decline of 36.5% from the year-ago quarter’s reported figure. Ollie's Bargain delivered a negative earnings surprise of 17.1%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Sports

Yahoo Sports