'The U.S. does not have the monopoly on future returns': Vanguard

It can be hard to stay with a diversified investment plan when U.S. tech stocks seem unstoppable and rock-bottom rates mean bonds pay a pittance.

But Vanguard, the world’s largest mutual fund company, says Canadians should stick to the plan.

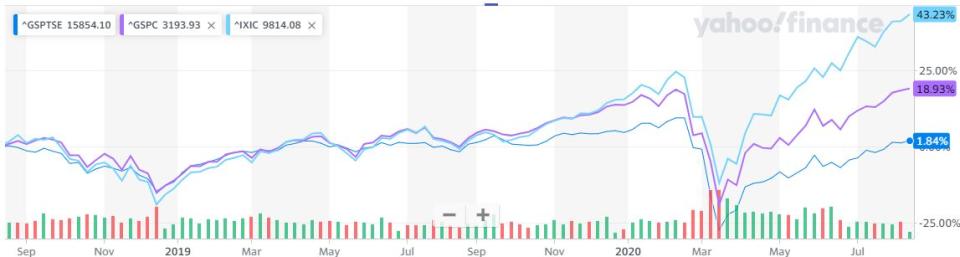

The broad S&P 500 (^GSPC) and the tech-heavy NASDAQ (^IXIC) have rebounded to new all-time highs after crashing in March when the COVID-19 pandemic shook markets.

But even though Canada has done a better job at containing the virus’s spread, the TSX (^GSPTSE) has lagged and is still off of its pre-pandemic all-time high.

“The TSX’s two largest sectors are financials and energy. The energy sector has underperformed globally and so have financials, reflecting some of the lag in stock market performance,” Bilal Hasanjee, Senior Investment Strategist at Vanguard Canada, told Yahoo Finance Canada.

“As well, Canadian banks have a large lending exposure to the energy sector and, as such, this duplicates the sector weighting on the index.”

Vanguard’s median expectation for Canadian economic growth in 2020 is between five per cent and six per cent, as long as downside risks don’t materialize.

“First, and most importantly, is the high level of household debt in Canada. So far, fiscal and monetary policymakers have provided adequate support to avoid defaults in mortgage and consumer debt; however, if this support was reduced too abruptly or the economic slowdown led to permanent layoffs, these high levels of debt could worsen the economic decline, leading to growth below our baseline forecast,” said Hasanjee.

“Secondly, trade and commodity prices remain critical to Canada’s export sectors, so a slower recovery in the U.S, or global trade more broadly could lead to a slower recovery to pre-crisis levels in Canada.”

Despite everything Canada has going against it, Hasanjee says average returns will likely be on par with non-Canadian equities. He says Canadian and international exposure should be part of a Canadian investors’ portfolios.

“Past performance is no guarantee to the future performance, i.e., this trend of U.S. outperformance is not guaranteed to continue and broad global diversification can help manage a potential return to normal trends.” said Hasanjee.

“Finally, the U.S. does not have the monopoly on future returns – e.g., we see many innovative companies across Europe, China and wider Asia, expected to generate superior risk adjusted returns over a long term investment horizon.”

Fixed income doesn’t offer much income

COVID-19 helped push interest rates lower, which means fixed-income doesn’t pay investors much. Vanguard’s broad market bond fund (VAB.TO) currently pays around 1.2 per cent. Bank of America recently touted the end of the traditional 60/40 split between equities and bonds, because government bonds offer such low yields. But Hasanjee says it’s still the way to go.

“A balanced portfolio of 60 per cent stocks and 40 per cent bonds has proven itself throughout many different financial crisis’ with a track record dating back almost 100 years. In fact, the typical balanced portfolio has a similar 10-year forecast now (4.1 per cent) as it did pre-crisis (3.8 per cent),” he said.

But Hasanjee says the ratio can be adjusted based on age and appetite for risk.

“Investment risk tolerance is an individual question but generally, it makes sense for younger investors to have a lower weight in fixed income. For instance, pension savings options typically start out at 10 per cent bonds for investors in their 20s and rise to 70 per cent for those in their 70s and older.” he said.

Hasanjee says fixed-income exposure should also be diversified globally, but currency exposure should be hedged to take some risk off the table.

Stressing over retirement

A recent survey by Edward Jones highlights the importance of an investment plan for retirement, especially considering COVID-19’s effects on our finances.

It found one in three Canadian adults said they were not on track with their retirement savings. Canadians aged 55-64 without an employer pension plan said their median retirement savings is just $3,000.

Unexpected expenses (54 per cent) and the cost of long-term care (47 per cent) ranked as the top financial concerns for retirees rather than current economic uncertainty or the pandemic.

Even if it jeopardizes their own financial future, 63 per cent of retirees said they are willing to offer financial support to their family.

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Sports

Yahoo Sports