Targa (TRGP) Stock Down 2% Since Q1 Earnings & Sales Miss

Shares of Targa Resources TRGP have gone down 2.3% since the first-quarter 2022 earnings release on May 5.

The stock depreciation could be attributed to Targa’s top and bottom lines lagging the consensus mark.

Behind the Earnings Headlines

Targa reported a first-quarter 2022 adjusted net income of 6 cents per share, lower than the Zacks Consensus Estimate of 89 cents. The miss can be attributed to the operating margin in the Logistics and Marketing segment being lower than the Zacks Consensus Estimate and an increase in expenses. The operating margin in the ‘Gathering and Processing’ segment was $397.6 million, which beat the Zacks Consensus Estimate of $393 million, and the ‘Logistics and Transportation’ segment’s operating margin came in at $352.1 million, missing the Zacks Consensus Estimate of $367 million.

Moreover, the bottom line worsened from the year-ago quarter’s profit of 53 cents per share.

Adjusted EBITDA rose from $515.7 million a year earlier to $625.8 million in the first quarter of 2022.

Total revenues of $4.96 billion were 36.5% higher than the year-ago quarter’s level but missed the Zacks Consensus Estimate of $6.06 billion.

Before the earnings release, TRGP announced a quarterly dividend of 35 cents per share (or $1.40 per share annualized) for the first quarter of 2022. The dividend was paid out on May 16, 2022 to its shareholders of record as of Apr 29, 2022.

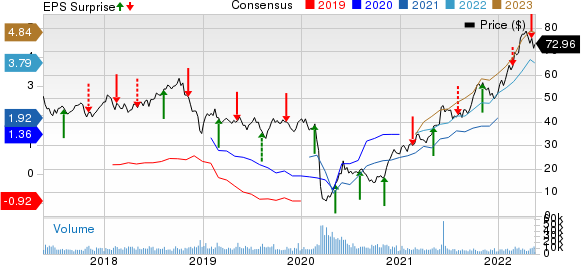

Targa Resources, Inc. Price, Consensus and EPS Surprise

Targa Resources, Inc. price-consensus-eps-surprise-chart | Targa Resources, Inc. Quote

Operational Performance

The Gathering and Processing segment recorded an operating margin of $397.6 million during the quarter, up 44.5% from the $275.1 million achieved in the year-ago period. Moreover, the Permian Basin volumes expanded year over year to 3,052.1 million cubic feet per day.

In the Logistics and Transportation (or the Downstream) segment, the company reported an operating margin of $352.1 million, up by a little less than 1% year over year. Targa saw the NGL pipeline transportation volumes rise from 342.5 thousand barrels per day (mbpd) to 459.7 mbpd, surging 34.2% year over year. Moreover, export volumes rose 20.3% year over year, while natural gas liquid sales rose about 5.5% year over year.

DCF, Capex & Balance Sheet

The first-quarter 2022 distributable cash flow was $494.6 million, 24.4% more than $397.4 million in the year-ago period.

As of Mar 31, 2022, TRGP had $135.9 million of cash and cash equivalents and total consolidated debt of $7.25 billion.

Guidance

Targa maintained its guidance for the 2022 average Permian natural gas inlet volumes to rise 12% to 15% more than the 2021 average volumes, which are projected to drive incremental volumes through its L&T systems.

Targa continues to expect that if prices average around the current levels for 2022, these will exceed the top end of its previously disclosed full-year 2022 adjusted EBITDA guidance range.

The company expected its 2022 adjusted EBITDA between $2.3 billion and $2.5 billion in February.

Zacks Rank & Key Picks

Targa currently carries a Zacks Rank #3 (Hold). Some better-ranked players from the energy space are ConocoPhillips COP, Marathon Oil MRO and Cenovus Energy CVE. While ConocoPhillips and Marathon Oil each carry a Zacks Rank #2 (Buy), Cenovus Energy sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ConocoPhillips is valued at around $138.5 billion. The consensus estimate for ConocoPhillips’ 2022 earnings has been revised 38.8% upward over the past 60 days.

COP beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 7.6%. ConocoPhillips has rallied around 98.2% in a year.

Marathon Oil has a projected earnings growth rate of 201.3% for this year. The Zacks Consensus Estimate for Marathon Oil’s 2022 earnings has been revised 51.6% upward over the past 60 days.

Marathon Oil beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 23%. MRO shares have surged around 147.8% in a year.

Cenovus Energy is valued at more than $41.7 billion. The Zacks Consensus Estimate for Cenovus Energy’s 2022 earnings has been revised 7.8% upward over the past 60 days.

The Zacks Consensus Estimate for CVE’s 2022 earnings is projected at $2.62 per share, up about 223.5% from the projected year-ago earnings of 81 cents. CVE shares have rallied around 168.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Targa Resources, Inc. (TRGP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Sports

Yahoo Sports