Shares in Asos Rocket After Report of Approach by Alibaba-backed Turkish Retailer

LONDON — Shares in Asos shot as high as 13.2 percent to 4 pounds after it was revealed that the online retailer had received a takeover offer from the Alibaba-backed Turkish online retail platform Trendyol last December.

Quoting unnamed sources, The Sunday Times revealed over the weekend that the Turkish company had offered 1 billion pounds, or $1.24 billion, valuing Asos between 10 pounds to 12 pounds per share.

More from WWD

Asos, which has been hit hard by shoppers’ return to the high streets and a sharp increase in costs, never disclosed the information to the markets, and declined to comment on the reported approach.

The paper revealed that Trendyol has been working with Morgan Stanley on the bid, but there are no talks currently underway. It’s believed that Trendyol offered the bid to Bestseller owner and Danish fashion tycoon Anders Holch Povlsen, Asos’ largest shareholder.

Founded in 2010 by Demet Mutlu, Trendyol raised $330 million from Alibaba in 2021, as part of a $1.5 billion investment agreement led by General Atlantic and SoftBank Vision Fund 2. The deal values the company at $16.5 billion.

Trendyol has been a leader in growth in the Chinese e-commerce giant’s international commerce business, which also includes Lazada, AliExpress and Daraz.

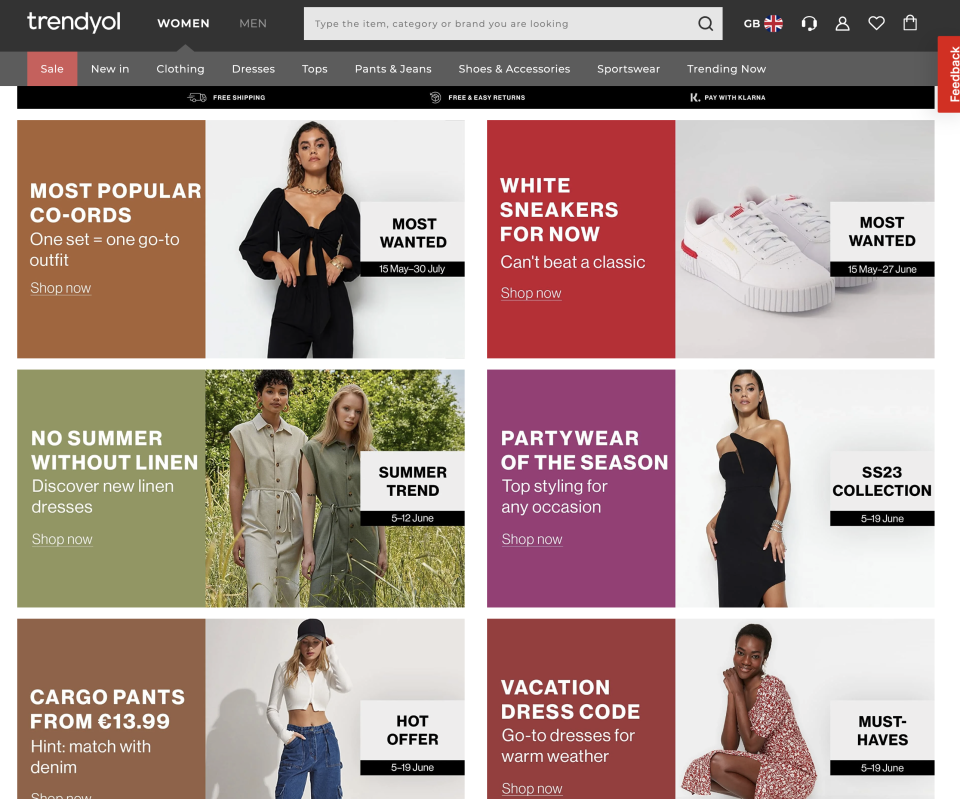

The site offers a wide range of fashion items for both genders at an affordable price point, and stocks brands such as Champion, Slazenger and a slew of local fashion labels.

Asos, meanwhile, has seen its revenue and profit drop since the world began to emerge from the pandemic. Shares in Asos have plunged more than 93 percent in the past two years, and it dropped out of the FTSE 250 this week as a result.

Credit insurers such as Allianz Trade and Atradius have pulled or reduced their cover for Asos’ suppliers following concerns about its drop in revenue and profits, and rising costs.

In the six months that ended February 2023, group revenue fell 8 percent to 1.8 billion pounds. Adjusted earnings before interest and taxes was negative 69.4 million pounds in the period, compared to a profit of 26.2 million pounds year-over-year.

The company also introduced a 300 million pounds cost-cutting package in January, scaling back offices, distribution centers, and brand mix.

Shares in Asos closed at 3.76 pounds on Monday, up 7.39 percent from Friday.

WWD has reached out to Trendyol for comment.

Best of WWD

Yahoo Sports

Yahoo Sports