'Encouraging' signs at Primark as stores reopen

Sales at Primark have beaten expectations since stores began re-opening in May, but performance is uneven across the country due to changes in ways of living and working.

Associated British Foods (ABF.L), which owns Primark, said in a trading update on Monday that sales across its business had “exceeded our expectations” in recent weeks.

“In the latest four-week UK market data for sales in all channels, Primark achieved our highest ever value and volume shares for this time of year,” the company said.

While Primark’s UK sales are down around 12% over the last 12 months due to extended store closures, ABF said “sales performance since reopening has in aggregate been reassuring and encouraging.”

Shops benefited from pent-up demand when they began re-opening and sales since re-opening have hit £2bn ($2.61bn), ABF said.

Primark is expected to make a profit “at the top end” of the £300m to £350m range ABF had previously told investors to expect. Primark made an operating profit of £913m last year.

While performance overall is recovering, ABF said some stores were doing better than others “reflecting the current circumstances of our customers including increased home working, less commuting and much less tourism.”

Retail parks, town centre, and shopping centre Primarks are performing well, while inner city locations in heavy commuter and tourist destinations like London are underperforming.

“Our 16 largest destination city centre stores contributed 13% of total sales pre-COVID-19 and 8% of sales after reopening,” ABF said.

Primark had made progress tackling a stock backlog caused by lockdown, ABF said, and the chain has benefited from a weak US dollar when ordering new stock.

As well as Primark, ABF also owns a major sugar business, grocery brands like Twinings tea, and an agricultural and ingredients business. The company said all parts of its business were performing well.

ABF said it has developed a “flexible” contingency plan to respond to any further COVID-19 restrictions and said it has “completed all practical preparations should the UK exit the Brexit transition period with or without a trade deal.”

“There is relatively little group cross-border trading between the UK and the EU,” ABF said.

Russ Mould, investment analyst at stockbroker AJ Bell, said another lockdown would “significantly undermine the recent sales momentum.”

“Primark needs a measure of normality to do well,” he said. “Its low ticket business model is not a proposition that seems likely to translate well to the internet and the company has not gone down this route, not even considering it at the height of the coronavirus restrictions.”

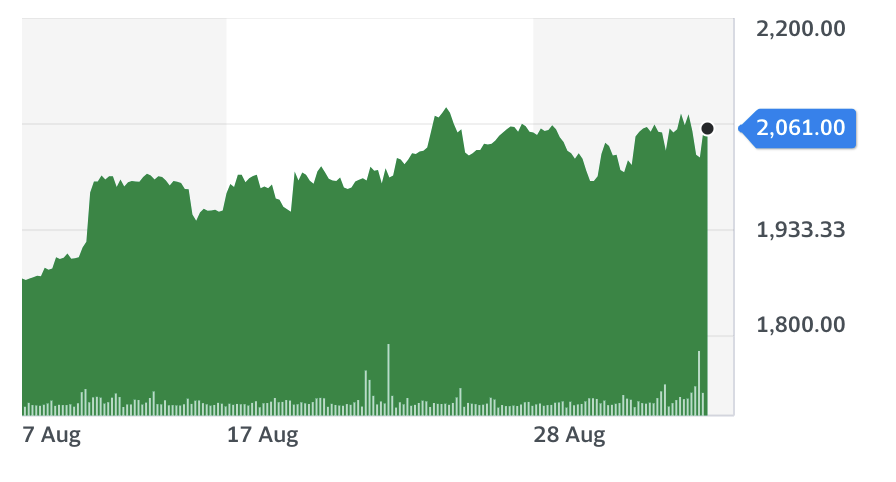

Shares rose as much as 5.5% at the open in London, before falling back to a gain of 2% on the day.

Yahoo Sports

Yahoo Sports