No school property taxes? Abbott says Texas can get there. But there’s a fight to resolve | Opinion

There’s two ways politicians look at your money:

It’s your money, you should keep a lot of it.

It’s your money, but we should take most of it to help others.

In a lot of ways, this one thing separates conservatism from liberalism, Republicans from Democrats.

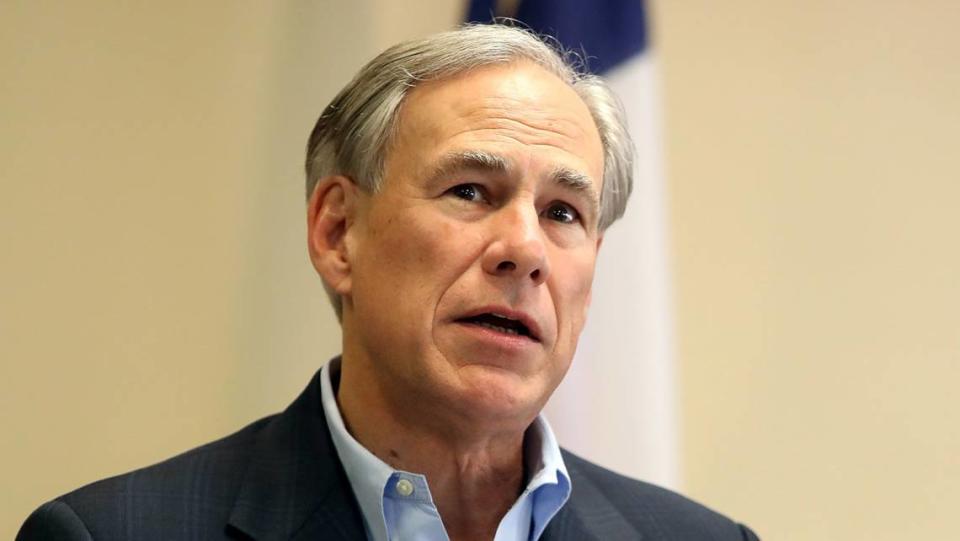

To that end, one of Gov. Greg Abbott’s final tests this legislative session is whether he can fulfill one of the core tenets of conservatism in one of the most practical ways possible: Can Abbott and the Legislature give money to the people the state otherwise would have spent by reducing school property taxes now and — someday — eradicating them altogether?

Property taxes is not a sexy topic, and it’s a complicated one. But what’s appealing and simple is the idea that if this were solved, homeowners would get to have additional money for their own lives, instead of the state spending its surplus revenue on additional government programs or a burgeoning bureaucracy.

Can the Legislature keep this in mind?

Of course, Americans should pay some taxes, but most people would agree they pay too much in federal income tax, and Texans definitely pay some of the highest property taxes in the country.

This is unfortunate.

Lawmakers have spent weeks debating the issue of property taxes, how they got so high, whether they should lower them, and now, how. They’re locked in a special session about it. What matters most is that they find a way that works. Abbott’s plan, which mimics one advocated by the Texas Public Policy Foundation, a conservative think tank in Austin, seems like it will work if everything works as it should — and that’s a big if.

Lt. Gov. Dan Patrick is lobbying for a different way to reduce property taxes, and that’s primarily through a higher homestead exemption. Raising homestead exemptions has been tried before and taxes didn’t go down because property values went up. Compressing rates — Abbott’s plan — has been tried before and didn’t work well, either. In 2019, the legislature made reforms to help this function better via SB2. The compression amount will be larger than last time, according to proponents, and that’s what will make this work better.

“We’re starting out in just an extraordinary position,” Abbott told a small group of reporters on a call June 2. “Because the state of Texas has the fastest-growing, largest economy in America, we’re doing so well, we have the largest budget surplus in America. Everyone in the Capitol understands that is money that belongs to the taxpayers. We rightfully have agreed on $17 billion going back to the taxpayers this session to reduce the burdens they face.”

The state can drive the school district maintenance and operation tax down to zero over time, Abbott contends. If the state runs out of surplus money, which is probable, it can use its rainy day fund towards compression — or, ideally, cut spending.

“As home values increase going forward, it will compress the property tax rates every year,” Abbott said on the call. “This has not only a lasting affect, but as we go along, it will have a reduction effect for property owners, which is different than a property tax exemption. As homes increase in value, the value of that exemption begins to decrease.”

Economist Dr. Vance Ginn, who has worked for the Texas Public Policy Foundation, has been tweeting his support for compression over homestead exemptions. As neither an economist nor a tax expert, this is a subject I’m more than happy to defer to the experts over. Since most Texans aren’t either, they’ll likely have a similar strategy.

Compared to the rest of the nation, or at least to where the nation’s been headed when it comes to fiscal policy — high gas prices, inflation and federal interest rates — just the fact that Abbott admitted Texas had a massive surplus and planned to return it to Texans is a bit radical. Don’t think so?

Can you picture former New York Gov. Andrew Cuomo doing that? Or California’s Gov. Gavin Newsom? My home state, Minnesota, had a $17.5 billion surplus. Gov. Tim Walz signed bills into law that would create some tax rebates and credits for families but also new tax increases. Republicans were disappointed Walz didn’t send even more back to the taxpayers.

In other words: In a lot of different states, a budget surplus could have been handled a lot differently meaning you’d never see a dime or even see a debate about whether it should be returned to you.

Most people don’t think about politics on a daily basis: They think about things like how to make ends meet, their healthcare premiums, or that new, weird sound their car is making. However, for the 64% of Texans who own homes, having a bit more money in their pocket because their property taxes went down just might help with all these things that give people anxiety.

“Do we as Texans want to achieve the goal of driving that property tax burden down to zero? ... That’s what I want to do,” Abbott said. “We can do it.”

The average Texan is too busy working or taking care of family to parse through the best way for lawmakers to reduce or eradicate property taxes. That’s what they’re electing lawmakers to figure it out. So now, they just need to be done with it.

Yahoo Sports

Yahoo Sports