10 Money-Saving Resolutions You’ll Actually Keep

As 2023 turns into 2024, many Americans make resolutions of all kinds, from losing weight to keeping in better touch with friends and family.

Experts: Make These 7 Money Resolutions If You Want To Become Rich on an Average Salary

Find Out: Owe Money to the IRS? Most People Don’t Realize You Can Do This — Today

Financial resolutions are also quite popular. Yet, human nature is to make big, hard-to-reach goals at the beginning of the year that quickly fall by the wayside as they are so difficult to attain.

Since financial planning is so important to your future, you don’t want to set up money goals that you abandon within a few short weeks or months. Here are some bite-sized financial resolutions you can make that you can actually keep throughout the year.

Bump Up Your Retirement Plan Contributions by 1%

One simple way to improve your long-term finances with minimal effort is to bump up your retirement plan contributions in small increments.

Imagine that you currently earn $50,000 per year and you contribute 5% to your 401(k) plan. If you bump that up by 1% annually, you’ll be kicking in just $41.67 extra per month. That’s a money-saving resolution you could easily keep.

If you want to get more aggressive, try raising your contribution level by 1% per quarter. That would mean by the end of the year you’d be contributing 9% of your income, or $375 per month, up from $208.33 per month.

That’s still not a huge increase, but you’d be getting very close to the 10% or more that most financial advisors recommend you save in your retirement accounts.

Suze Orman: This Common Financial Choice Is the ‘Biggest Waste of Money Out There’

The Ultra-Rich Spend Their Holidays in These 5 Locations: How You Can Visit for Cheap

Sponsored: Get Paid To Scroll. Start Now

Start an Emergency Fund

Perhaps even more important than bumping up your retirement plan contributions is making sure you have an adequate emergency fund. Having an emergency fund is essential to keeping yourself out of debt when you face unexpected expenses.

While it can be hard to immediately dump $20,000 or more into an emergency fund, starting out slowly is an easy way to stick to it.

For example, if you have no emergency fund at all, try putting aside just $100 per month. Within a year, you’ll have $1,200. While not as large as it should be, it’s still big enough to cover most short-term emergencies you’ll face, such as a hospital co-pay or a car repair.

More: Financial Experts Say To Always Buy the Cheapest Version of These 10 Things

Review Your 2023 Spending

Perhaps the easiest financial resolution to keep is to review your prior year’s spending.

Even the most dedicated budgeters are often surprised when they see in black and white how much money they spent in a year. If you already know you’re not good at sticking to a budget, seeing the cold hard facts can be downright shocking.

But there’s a lesson in this type of annual review, and it’s not to make yourself feel bad. Rather, looking at your actual spending can show you just where you tend to overspend, and where you can likely cut back.

While you don’t have to deny yourself all pleasures, it’s likely that you, like most Americans, have overindulged in certain types of spending. Use this time to review your spending patterns and identify where you can make easy cutbacks.

Don’t Buy Anything Unless You Get Rid of Something Else

One age-old decluttering suggestion is also a great way to save yourself some money. Resolve to not purchase anything new unless you get rid of something you already have that’s similar.

For example, if you have 10 pairs of shoes but are just dying to buy a new one, promise yourself that you can’t make that new purchase unless you get rid of something you already own.

Over time, you’ll be left with only your favorite items, and you’ll likely restrain your future spending since you won’t be willing to part with what you already have.

Don’t Replace or Upgrade Items Until Necessary

Americans in general are prolific consumers, and one of the biggest sources of American spending is the impulse buy.

How many times have you seen something shiny and new in a store and convinced yourself to buy it, even though you already have something very similar at home? Make a resolution that you will only replace or upgrade an item you own if it’s truly worn out or not working.

For example, if you have a phone that’s two years old and in perfect working condition, don’t allow yourself to buy the latest hot new phone just because it has a few extra features.

Make do with what you have until it’s no longer useful, and you’ll be taking a big step toward saving lots of money.

I’m a Shopping Expert: 9 Items I’d Never Put in My Grocery Cart

Eat All the Food in Your House

In addition to being great consumers, Americans are also guilty of wasting lots of food. According to Feeding America, nearly 40% of all food in the United States is wasted, amounting to more than $218 billion in annual food waste — the equivalent of 130 billion meals.

If you want to save money, this is a great place to start, and it’s easy to do. Simply check your refrigerator every day for what you have and what might be going bad soon and eat that instead of picking up something new from the grocery store or a restaurant.

Not only will you be preventing waste, but you can also save a significant amount of money every year.

Set Up Alerts and Reminders for Your Bills

Late fees are something that no one should pay if they are trying to save money. Yet, countless Americans get hit with late fees every month, sometimes because they are just not paying attention.

Since life can get busy, set up automatic reminders for all of your bills so that you never miss a payment date. And since late fees can be $30 or more every month, simply staying on top of when your bills are due can be an easy way to stop yourself from paying for nothing.

Streamline Your Subscriptions

If you’re like most people, you have subscriptions to some of your favorite entertainment options, such as Netflix, Hulu, Pandora and the like. Although it’s nice to live in an era in which you can customize your own entertainment packages, things can get out of hand quickly.

If you just use Netflix and Hulu, for example, you’re on the hook for somewhere between about $20 and $40 monthly. But if you add on Disney+, Discovery+, Apple TV, Max and some type of live streaming services, you could easily find yourself paying $300 per month or more.

Add in your music subscriptions like Amazon Unlimited Music, Pandora, SiriusXM and the like, and before you know it, you may be paying $400 to $500 per month in various subscriptions, some of which you may not use all that often.

Choose what you really enjoy watching most and pare down your other subscriptions to save some significant money every month.

Find: 5 Ways To Earn at Least 5% APY on Your Money (Without Using the Stock Market)

Don’t Add to Your Debt

A common New Year’s resolution is to pay off all of your debt, but realistically, that’s hard to do for most people, especially all at once.

A much more manageable money-saving resolution is to simply avoid taking on any new debt. If you can stop digging your hole deeper, it’s the first step toward finally getting out of debt.

Once you’ve balanced your income and spending, and aren’t getting in further over your head, you can focus on actually paying down the debt you already owe.

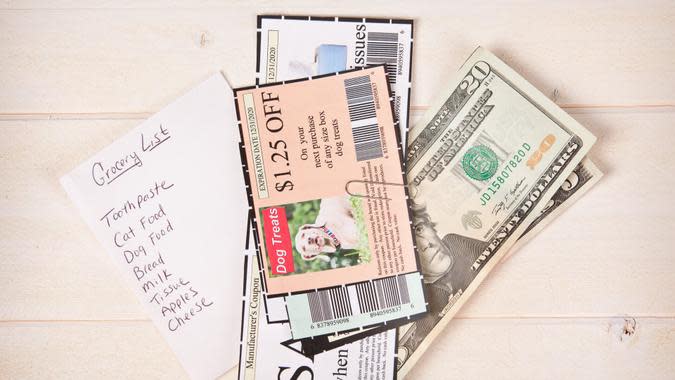

Use Coupons and Shopping Portals

Coupons are an easy way to save money on your shopping bills, but sometimes they can be an inconvenience for some.

Online coupon codes make it easy to save money when you’re shopping on your computer or mobile device, and you can even set up pop-up windows showing you how much cash back or savings you can get at particular sites that you visit. You can also shop directly through dedicated online shopping portals to rack up savings.

Whether you prefer the old-school method of couponing or the more modern online shopping portals, it’ll be easy to save some money on the items you already buy.

Laura Beck contributed to the reporting for this article.

More From GOBankingRates

I'm a Financial Expert: Here's How You Can Save $10K or More in the Next Year

How to Get $340/Year in Cash Back -- for Things You Already Buy

4 Reasons You Should Be Getting Your Paycheck Early, According to An Expert

10 Ways to Turn Your Six-Figure Salary Into Generational Wealth

This article originally appeared on GOBankingRates.com: 10 Money-Saving Resolutions You’ll Actually Keep

Yahoo Sports

Yahoo Sports