Markets cautious as coronavirus vaccine trial delayed

Watch: Johnson & Johnson pauses COVID-19 vaccine trials due to illness

Asian shares had a post-holiday cooling off and European shares opened weaker as caution on the vaccine front started to be felt in the market on Tuesday.

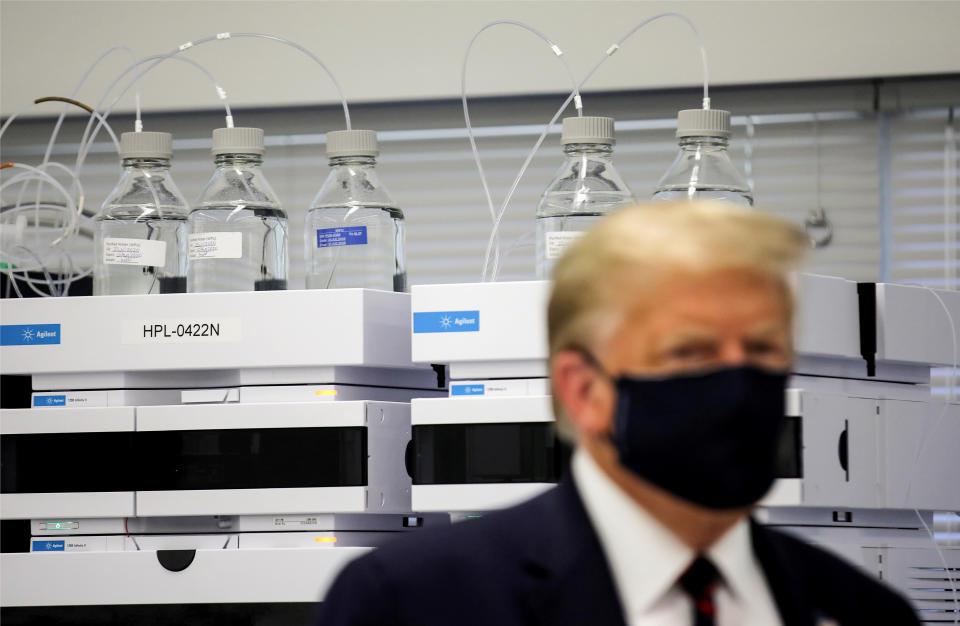

Risk sentiment increased overnight as Johnson & Johnson (JNJ) said that its COVID-19 Phase 3 trial has been paused due to an unexplained illness in a participant. There are also reports out of China that Sinopharm (1099.HK) has started to administer its two vaccines to residents in Wuhan and Beijing.

European markets opened in negative territory and remain lower at around 2:30pm in London. The pan-European STOXX 600 (^STOXX) was down 0.6%. Germany’s DAX (^GDAXI) was also lower by 1.1%, and France’s CAC 40 (^FCHI) tilted down by 0.8%. The FTSE 100 (^FTSE) was down by 0.6% in London.

The latest batch of UK data shows that the labour market fallout from COVID-19 has been worse than expected.

Unemployment rose more than expected over the summer in the UK, hitting 1.52 million as the COVID-19 crisis triggered a record surge in redundancies. The rate rose from 4.1% between May and July to 4.5% between June and August, according to the Office for National Statistics published on Tuesday.

“We always thought that a more marked weakening in the labour market was on the cards and to some extent this just means that some of the bad news has already happened,” said Paul Dales, chief UK economist at Capital Economics.

“But the combination of the end of the national furlough scheme later this month and the new COVID-19 restrictions that may extinguish the economic recovery for a few months means that the unemployment rate may yet rise to between 7% and 8%.”

Concerns of further fallout from the virus on the economy continue as UK prime minister Boris Johnson unveiled on Monday a new tiered alert system for England, which would see different areas grouped into “Medium,” “High” and “Very High.”

Areas that are deemed to be under a very high alert will see pubs and bars close, though shops and schools are expected to remain open.

The UK government also announced a sharp rise in cases on Monday, with 13,972 added to the growing national figure. The Scientific Advisory Group for Emergencies (SAGE) has said it is "almost certain that the epidemic continues to grow exponentially across the country."

READ MORE: UK unemployment hits 1.5 million on record leap in redundancies

Dutch prime minister Mark Rutte is expected to announce stricter measures and Italy’s prime minister Giuseppe Conte is also reportedly looking at additional restrictions on private parties, amateur sports activities and social gatherings.

Markets will also focus on the start of the Q3 earnings season with Tuesday’s releases including Johnson & Johnson, JPMorgan Chase (JPM), Citigroup (C) and BlackRock (BLK).

On the elections front in the US, optimism abounds over expectations of a Democratic win in the upcoming election which could set markets up for a substantial fiscal stimulus next year. Democratic presidential candidate Joe Biden holds a poll lead over President Donald Trump, with the FiveThirtyEight and RealClearPolitics poll averages now putting Biden +10.4pts and +10.2pts ahead respectively.

US markets are mixed.

S&P 500 (^GSPC) was down by 0.3%, Dow Jones (^DJI) slid lower by 0.4%, and Nasdaq (^IXIC) was up by 0.3%.

It was a mixed picture for Asian markets as well.

Japan’s Nikkei (^N225) is up 0.2%, Hong Kong’s Hang Seng’s (^HSI) morning session was canceled as the city faced a typhoon warning, China’s Shanghai Composite (000001.SS) tilted upward by 0.04%. The KOSPI (^KOSPI) in South Korea is slightly down by 0.02%.

Watch: What are negative interest rates?

Yahoo Sports

Yahoo Sports