A COVID-19 testing startup with 'no history of success' faces lawsuit over accuracy claims

In the years leading up to 2020, a tiny Utah startup focused on molecular testing faced a shaky future.

Since becoming publicly traded in 2017, Co-Diagnostics – part of Salt Lake City's politically connected Silicon Slopes business community – had been losing money.

In its 2019 annual report, the company said it needed to overcome the disadvantages of being a startup with “no history of success and no respect of the medical and testing professionals.” It was deep in debt, unprofitable and had no major customers. Its share price in 2018 was low enough that the company was at risk of being removed from a major stock exchange.

Then came COVID-19.

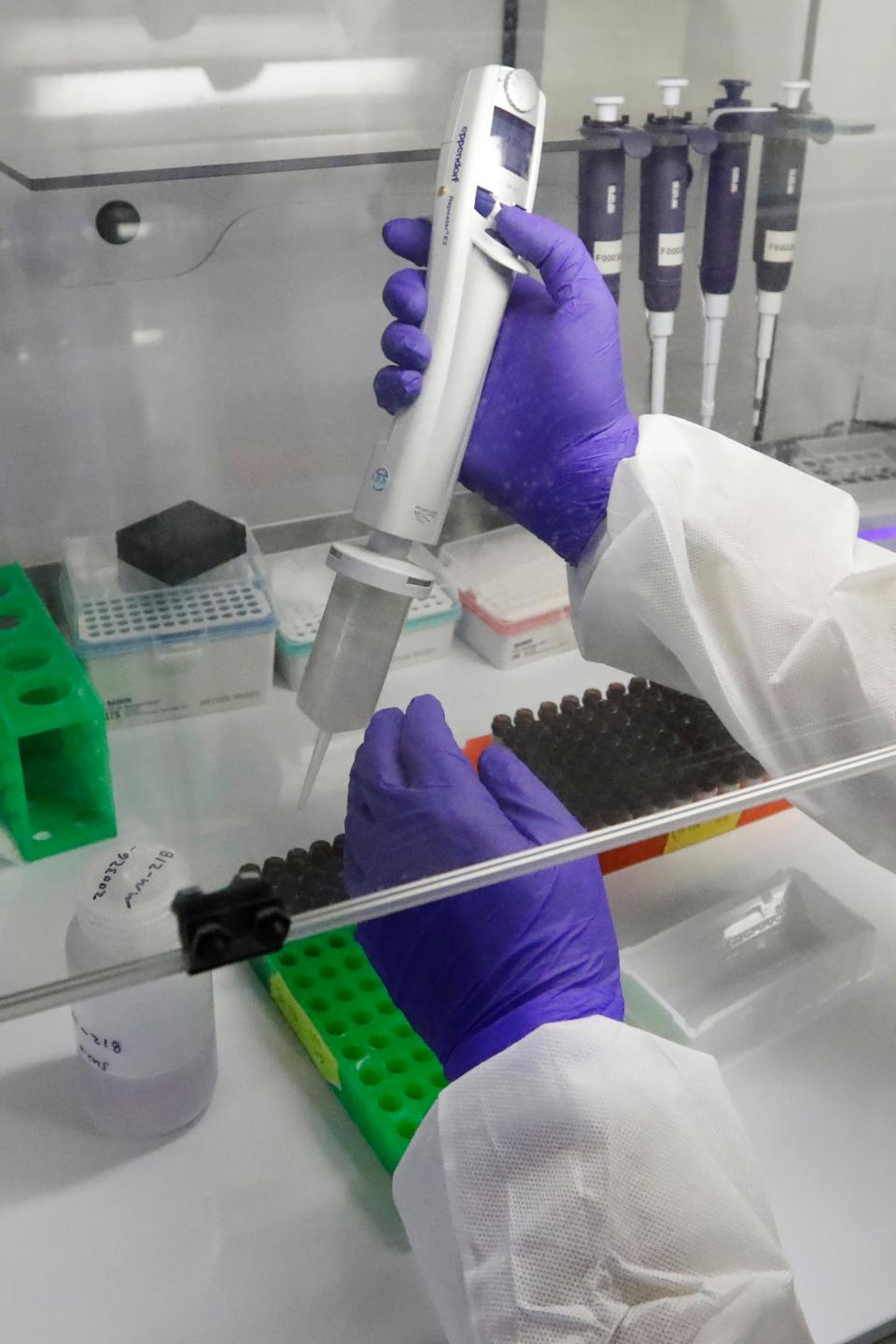

The country needed tests for the virus, fast. The 25-employee firm was able to create a PCR test and get it approved for sale in Europe at breakneck speed in February 2020.

Another Utah startup, Nomi Health, took notice and subcontracted Co-Diagnostics' kits for testing programs throughout Utah, Iowa, Nebraska, Tennessee and Florida. Software firms Domo and Qualtrics provided dashboards and test surveys as part of the Utah quartet that was paid at least $219 million by those states for their services.

With its test-kit sales surging in spring 2020, the company had pulled off a major turnaround by Wall Street standards.

Profits skyrocketed, shares soared, and the total compensation awarded to Chief Executive Dwight "Ike" Egan – formerly a music director for the Osmond family singing troupe – surged from $460,000 in 2019 to more than $1.4 million in 2020 and $2.2 million in 2021. Other insiders profited by selling their stock, which had surged from 91 cents a share in early January 2020 to $30.80 just seven months later.

Executives at Domo and Qualtrics also saw their compensation soar following their involvement in the testing, while Nomi secured major investments in December 2021 to help the company expand.

USA TODAY previously reported how it relied upon more than 30,000 documents and dozens of interviews to show how Nomi and the other Utah businesses used political connections to initially get no-bid deals from four Republican governors in spring 2020 and one more the following year.

In April 2020, reporting from The Salt Lake Tribune began to question the accuracy of the Nomi testing system using Co-Diagnostics' product.

USA TODAY found public health officials and politicians expressed concern about the accuracy of COVID-19 testing sites run by Nomi in at least four states. Only Tennessee canceled its relationship with Nomi after its Department of Health found "a number of problems" with the testing system including low-level contamination and inconsistent results.

Co-Diagnostics noted that Tennessee’s report found the company’s PCR test performed as expected and said its lab customers have validated the performance of its tests.

In March 2020, Co-Diagnostics claimed its COVID-19 tests demonstrated 100% sensitivity and specificity – metrics used to define a test's accuracy.

By May 2020, the U.S. Food and Drug Administration made clear that no diagnostic test is 100% accurate “due to performance characteristics, specimen handling, or user error” in response to another COVID-19 test from health care company Abbott that was producing false negative results.

Co-Diagnostics investors began scrutinizing the firm's claims, and the company now faces a federal lawsuit accusing it of disseminating false or misleading statements regarding the test's accuracy to inflate its stock price and benefit the company's officers and directors.

Plaintiff Gelt Trading Ltd., a Cayman Island limited company that was a Co-Diagnostics shareholder, claims statements from Co-Diagnostics founder Brent Satterfield and a press release "omitted material information that the Company’s tests have problems with their accuracy and are significantly less than 100% accurate."

Co-Diagnostics argued Gelt “fails to clearly state why the alleged misstatements are allegedly false,” and said in its 2020 annual report that it doesn’t believe the civil lawsuits it faces have “any merit.” It declined to comment on its insiders' transactions.

Insiders profit from selling stock

As reports were raising questions around Nomi sites using Co-Diagnostics' tests, officers and directors from the firm were able to reap the rewards of their company’s newfound success.

Co-Diagnostics director Richard Serbin sold all 50,000 shares of his common stock on May 19 and May 28, 2020, according to regulatory filings. The sale earned him just over $913,000 and took place shortly after The Salt Lake Tribune published an article questioning the accuracy of the firm’s tests. His compensation, which included stock awards, jumped from $316,830 in 2020 to $513,250 in 2021.

Officers and directors are usually expected to have "at least a token investment" in their companies, according to James Angel, an associate professor at Georgetown University who specializes in the regulation of global financial markets.

"When you see the insiders all selling, that's a pretty negative sign for the stock," Angel said. "That doesn't necessarily mean that the company is going to announce really bad news tomorrow and the stock has gone to zero. It could mean that they're just somewhat pessimistic about future developments and decide now's a good time for them to diversify."

In 2005, before joining Co-Diagnostics, Serbin pleaded guilty to falsifying records to an insurance company for disability benefits while employed. The Supreme Court of New Jersey the following year dismissed the charge after Serbin paid more than $220,000 in financial obligations, according to court documents. His pharmaceutical license was suspended six months.

Another Co-Diagnostics director, Eugene Durenard, sold off his remaining 50,000 shares of common stock for nearly $907,000 on May 20 and May 26, 2020, when the stock price was over $18. Had he sold those same shares a year prior, they would have been worth less than $45,000.

Meanwhile, Durenard’s total compensation, which includes stock awards, increased more than tenfold from $45,250 in 2019 to $513,250 in 2021.

Serbin and Durenard waited until June 5 and June 8 of 2020, respectively, to alert the Securities and Exchange Commission of their May trades through a Form 4 filing.

The SEC requires directors to file a Form 4 notice within two business days of the transaction date, but late filings happen "frequently" and are not an enforcement priority, according to Adam Pritchard, professor of securities law at the University of Michigan Law School.

He said the timing of the trades would be "much more damning" if the directors had sold the stock prior to the negative reports coming out.

Arthur Laby, co-director of the Rutgers Center for Corporate Law and Governance and an expert in securities law, added that there "could be a lot of reasons for delay, but there is seldom an excuse for a late filing," especially among two members of the company's audit committee.

SEC records show Co-Diagnostics' former chief financial officer, Reed Benson, also made nearly $1 million selling shares in 2020.

Before joining Co-Diagnostics, Benson was director of the firm Carlton Birtal Financial Advisory which was fined nearly $360,000 by Spanish regulators in 2006 for alleged securities violations.

Benson maintained that he was not involved in Carlton Birtal's business or affairs and had a business colleague and attorney manage operations. He also claimed he resigned as a director in 2003, but his employer could find no resignation recorded in any filing with Spanish authorities.

Benson in 2008 lost his job as CFO at Broadcast International, which Co-Diagnostics CEO Egan had co-founded, after the allegations from Spain came to light. He joined Co-Diagnostics as CFO and secretary in 2014 and in November 2020 made more than $950,000 selling off his remaining common stock.

"There could be perfectly innocuous and innocent explanations," Angel said of the transactions. But "these trades do raise a lot of questions."

Benson stepped down from his role as CFO in February 2021 but remained with Co-Diagnostics as general counsel. By August 2021, he was no longer in the executive office.

USA TODAY was unable to reach Benson, Durenard, Egan or Serbin by phone or email.

Co-Diagnostics accused of 'false and misleading' statements

Serbin and Durenard's trades are noted in a lawsuit directed at the company and its leaders that alleges Co-Diagnostics issued “false or misleading statements” regarding the tests' accuracy.

The lead plaintiffs' case, Gelt Trading v. Co-Diagnostics, points to a May 2020 press release from Co-Diagnostics that said test performance data demonstrated "100% sensitivity and 100% specificity."

"Those statements obviously misled investors to make them think that the product performed better than it did," said Michael Fasano, co-lead counsel for the plaintiffs in the Gelt Trading v. Co-Diagnostics case. "People in the market are really relying upon the news and the press releases of the company, as well as analysts, in order to make investment decisions."

If the court sides with Gelt Trading, Co-Diagnostics would need to compensate investors for their losses.

Counsel for Co-Diagnostics argued during oral argument that the press release would not have misled a reasonable investor because investors "should know that no test is 100% accurate," according to court documents.

Carmel, Milazzo & Feil LLP, who represent the testing firm, said of the lawsuit: "Co-Diagnostics stands behind the quality of our technology platform, and performance of our testing products. We refute the claims made and are vigorously defending this matter.”

The company's motion to dismiss the lawsuit was denied in March by Judge Jill Parrish of the U.S. District Court for the District of Utah.

Counsel at the SEC's Division of Enforcement has also raised questions about the accuracy of Co-Diagnostics' tests when used by Nomi. The agency sent emails to Utah state officials in the spring of 2020 asking to speak to someone about "concerns that have been raised about the reliability of the tests manufactured by Co-Diagnostics." The SEC was also interested in learning more about companies that may have received contracts or sub-contracts with TestUtah, the public-private partnership overseen by Nomi that ran testing in the state.

In a quarterly report filed shortly after the SEC emails, Co-Diagnostics said it received and responded to inquiries from the Financial Industry Regulatory Authority, Nasdaq and the SEC, but believed “no governmental authority is contemplating any proceeding" that would have a material adverse effect on the company.

The SEC declined to answer questions on the emails, noting that it does not comment on the existence or nonexistence of a possible investigation. Co-Diagnostics also declined to comment on the investigation.

Despite the raised suspicions, share prices for the company continued to climb. Co-Diagnostics hit a record closing price of $30.80 in August 2020, compared with just over $1.25 a year prior.

Two years later, Co-Diagnostics is still fighting the Gelt Trading lawsuit in court.

With state-funded COVID-19 testing going by the wayside, the company has shifted its attention to its at-home PCR diagnostic testing platform and the monkeypox outbreak. A July 11 release says the company shipped testing reagents for the monkeypox virus to an unnamed international distributor.

Share prices closed at $3.16 Wednesday on the Nasdaq.

Investments, compensation soar

The three companies and executives tied to Co-Diagnostics for the testing financially thrived during and after the pandemic, though Domo and Qualtrics already had a national presence with other customers.

Interviews and publicly available financial records show:

► Nomi secured $110 million from venture capital firms Rose Park Advisors of Boston and Arbor Ventures of Singapore in December 2021, while Nomi's profit-margin percentage was "in the teens," according to CEO Mark Newman. The investment firms declined to comment, and privately held Nomi does not disclose its financial documents or executive compensation.

► Total compensation for Joshua James, founder and former CEO of Domo, was $12.4 million in fiscal 2021. The previous year, he made just under $760,000 in total compensation. His earnings have since dipped but still remain elevated compared with pre-pandemic levels, with 2022 earnings at $8 million, comprised mostly of stock awards. The company is headquartered in American Fork, Utah.

► Domo CFO Bruce Felt made $645,370 in total compensation in fiscal 2020. His fiscal 2022 compensation was $4.7 million, with $3.7 million being stock awards. The company's revenue has increased almost 49% since 2020, to nearly $258 million, but Domo has consistently lost money during that time, including a $102 million loss in fiscal 2022.

► Qualtrics founder and executive chair Ryan Smith's compensation in 2019 totaled $142.9 million, mostly from stock awards. Total compensation dipped to $509,000 in 2020 but jumped to $540.5 million in 2021 as the company went public, with 99.9% comprised of stock awards. Smith also made $153 million after the firm went public in late January 2021 – one month after he bought the NBA's Utah Jazz.

The company, headquartered in Provo, Utah, has lost money the past three years, but losses shrank from $1 billion in 2019 to $272.5 million in 2020, before increasing to $1 billion last year.

► Zig Serafin, who was president of Qualtrics before being named CEO in July 2020, saw his compensation jump from $797,265 in 2020 to $540.5 million in 2021. The majority of the money in 2021 came from stock awards granted in connection to the initial public offering.

Newman said profits for his company, Nomi, headquartered in Orem, Utah, just north of Brigham Young University, were in line with other health care companies.

Nomi has repeatedly defended the accuracy of its testing system, noting that all of its tests are in good standing with the FDA and perform according to the FDA's emergency use authorization.

Spokeswomen for Co-Diagnostics, Domo and Qualtrics declined to answer questions about compensation for their executives, but they noted stock awards are paid over time and are valuable only if the company's stock price rises.

Exec bonuses, grants common

While millions of Americans lost jobs during the pandemic, the payouts to leaders at the three publicly traded Utah firms (Domo, Qualtrics and Co-Diagnostics) outpaced the nearly 19% jump in compensation to CEOs during the pandemic, according to research from the left-leaning Economic Policy Institute in Washington, D.C.

Nomi and its collaborators were among the myriad of companies across the U.S. that made millions of dollars during the pandemic as governments issued lucrative, emergency contracts starting in March 2020.

Two compensation specialists told USA TODAY that the increase in pay for executives at the three Utah publicly traded companies involved in the testing mirrored a trend with U.S. corporate leaders.

Tom Hickey, a corporate law attorney at Gunster in West Palm Beach, Florida, said there was plenty of "belt-tightening" for executives in 2020, when the pandemic caused widespread layoffs, and that it was common for CEOs to take pay cuts up to 40%.

But Hickey said that once the economy rebounded, those executives recaptured their lost pay and then saw increases in 2021 and this year in bonuses and stock grants.

Hickey said he had no experience with companies that provided COVID-19 testing, but he's spent more than 35 years representing companies and senior management in executive compensation.

Jody Thelander, of Miami, who runs a consulting company with more than 1,000 clients, said "top players are making more money" in tech and life science sectors, and executive compensation continues to rise because companies don't want to lose key employees.

'Throwing out money'

Those who worked on the front lines of the testing program also did well.

Cori Watkins, a nurse from Lincoln, Nebraska, said Nomi, which acted as the general contractor, paid her and other nurses $50 an hour to collect samples at drive-up testing areas.

"They were throwing out money like it wasn't theirs," Watkins said in an interview with USA TODAY this spring. "At the beginning of it, they had lots of money and a lot of people got rich."

Watkins said that while her pay was good, she quit after six months because Nomi didn't provide proper heating in the winter at drive-up testing sites.

Maggie Habib, a Nomi spokeswoman, said "front-line workers and clinicians such as Cori are superhumans who braved the elements every day."

Nebraska and Utah lawmakers have also told USA TODAY that they were not happy with the testing and that taxpayers didn't get their money's worth.

This article originally appeared on USA TODAY: Nomi Health COVID testing supplier faces lawsuit over accuracy claims

Yahoo Sports

Yahoo Sports