British Airways owner set to raise £2.5bn as airline leaders warn 87,000 more jobs at risk

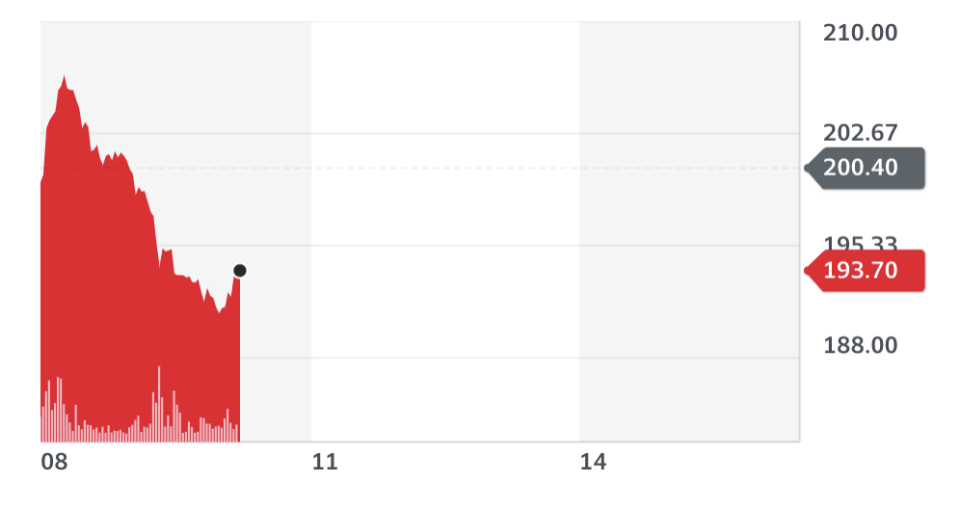

British Airways owner IAG (IAG.L) began issuing billions in new shares at a heavily discounted price on Thursday, a process it hopes will raise more than €2.7bn (£2.5bn).

The rights issue came as IAG confirmed that more than 8,200 employees at British Airways had lost their jobs by the end of August as part of the restructuring process launched in the wake of the coronavirus pandemic.

The airline is currently in the process of reducing its overall headcount by as much as 13,000.

An additional 87,000 jobs will be lost in the next few months if the UK government keeps travel quarantines in place until Christmas, global trade body IATA has estimated. Airline leaders have warned that the restrictions could cause a £4.6bn hit to the UK economy.

IAG said on Thursday that it will issue 2.97 billion new shares at €0.92, a figure that represents a 36% discount on the airline group’s closing price on Wednesday.

The rights issue, which is designed to bolster IAG’s balance sheet, will allow existing shareholders to subscribe to three new shares for every two they currently own. The funds raised will also be used to pay down debt.

READ MORE: Lloyd's of London expects to pay £5bn to cover COVID-19 claims

The increase in the company’s total share capital was announced in July and approved by shareholders earlier this week.

Shareholders have no obligation to participate in the rights issue, and they can also sell the rights to another party.

IAG, which also owns Aer Lingus and Iberia, said on Thursday that, though its capacity will be lower than it had previously expected, it still hoped to break even in its fourth quarter.

“This is as a result of mitigating actions taken to reduce operating expenses further and enhance working capital,” the airline said.

IAG said there had been “no change” to its expectation that it will take until at least 2023 for passenger demand to recover to pre-pandemic levels.

READ MORE: Virgin Atlantic to axe a further 1,150 jobs in restructuring

Giving an update on its restructuring plans, the airline group said that the total headcount at British Airways had been reduced by 8,236 by the end of August, with most employees departing via its voluntary redundancy process.

British Airways has concluded labour agreements with pilots, engineers and Heathrow customer service staff, it said.

It said that an agreement in principle had been reached with union Unite with respect to cabin crew staff, noting that a consultative ballot would start shortly.

Airlines are confronting an unprecedented crisis in coronavirus, and have announced tens of thousands of job cuts in the wake of the pandemic.

Virgin Atlantic said last week that it was axing a further 1,150 jobs at the airline. The fresh job cuts come on top of the 3,500 roles that the company slashed in June.

Watch - Yahoo UK’s Finance Editor, Edmund Heaphy explain what a no-deal Brexit is

Yahoo Sports

Yahoo Sports