Pound under pressure with Brexit talks on a knife edge

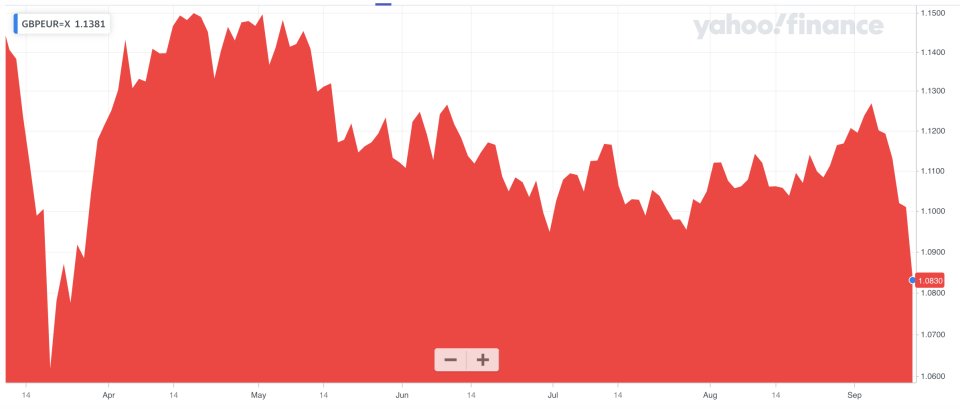

The pound remained near six month lows against the euro on Friday, amid continued sky-high tensions between the UK and EU over Brexit.

Sterling was down 0.2% against the euro (GBPEUR=X) to €1.0789 by late afternoon in London and was down 0.1% against the dollar (GBPUSD=X) to $1.2779. Sterling had sold off sharply against both pairings on Thursday.

READ MORE: The UK economy's rebound lost momentum in July

“The pound has had a torrid week slipping to six month lows against the euro and sliding sharply against the US dollar as this week’s EU/UK trade talks broke up in acrimony and recrimination,” said Michael Hewson, chief market analyst at CMC Markets.

Earlier on Friday, data showed the UK economy grew by 6.6% in July. Hewson said the figure showed the UK was recovering from the COVID-19 crisis faster than most mainland European economies.

However, the GDP figure was “almost a side show” compared to Brexit, he said.

Sterling dropped over 1.5% against both the euro and dollar on Thursday after the EU threatened to walk away from Brexit trade talks and take legal action against the UK unless it backed down from plans to break part of the Withdrawal Agreement. It marked the biggest daily drop for the pound since March, when investors were selling amid a panic over the COVID-19 pandemic.

READ MORE: Pound dives as EU threatens to end Brexit trade talks over Internal Market Bill

The pound is currently at its lowest level against the euro since March and the British currency has fallen over 3.5% since the start of September.

“We’re now in a no man’s land of levels with very few GBP [Great British pound] barriers to judge where GBP can find support here,” Jordan Rochester, a currency strategist at Japanese bank Nomura, said on Friday.

Trade talks will continue next week despite the EU’s threat to walk away from negotiations. However, almost no progress has been made in the eight rounds of negotiations so far and there is little sign of the deadlock being broken.

EU chief negotiator Michel Barnier on Thursday evening said “significant differences” remain between the two sides. Barnier said in a statement the EU was “intensifying its preparedness work” for a possible no deal outcome.

Chris Turner, ING’s global head of markets, and Petr Krpata, the bank’s chief European currency strategist said the pound would likely “keep struggling heavily” next week.

“We expect the pressure on GBP to continue building next week as until-recently complacent investors adjust to the new reality of a heightened no-deal Brexit risk,” the pair wrote in a note on Friday.

ING said there was now “at best a 50-50 chance of a deal between the UK and the EU”.

Robert Wood, a UK economist with Bank of America, said there was a growing “risk of a downward spiral in talks and no deal becoming inevitable”.

“The UK government seems convinced that the route to a deal is brinkmanship, so we are not prepared to drop our base case of a deal yet,” Wood and colleagues wrote in a note on Friday. “But it's a very close call.”

George Buckley, Nomura’s chief UK and European economist, said most analysts in the City have now “either switched their base case to a no-deal Brexit or at least [are] poised to do so”.

Yahoo Sports

Yahoo Sports